America's "Excess" Household Savings Are Going Away

The highest-income households pocketed a windfall earlier in the pandemic that they have since used to cover capital gains tax payments, weak asset income, and inflation.

Americans liquidated more than $1 trillion of “excess” savings in 2022, eliminating more than half of the surplus accumulated since the pandemic began. If the current pace continues, the entire stock will vanish by the end of this year.

The good news is that this does not seem to be putting undue pressure on most Americans’ balance sheets. Debt is not rising unusually rapidly, while spending is moving in line with measures of most Americans’ earnings. Instead, “saving” as reported by the Bureau of Economic Analysis (BEA) has been depressed by the unusual combination of weak interest and dividend receipts relative to inflation alongside high capital gains taxes.

The Origins of the “Excess”

People all over the world slashed their spending in the initial months of the pandemic, and Americans were no different. Inflation-adjusted consumption was consistently below what would have been expected based on the pre-pandemic trend until vaccines became widely available in spring 2021. Weak demand also depressed prices in the first year of the pandemic, particularly for gasoline, clothes, and pandemic-affected services such as air travel.

Americans spent about $950 billion less in February 2020-February 2021 than would have been expected if the prior trend had persisted. Employment and asset income plunged as well, but not quite as much. The resulting precautionary savings were worth almost $300 billion in the first months of the pandemic.

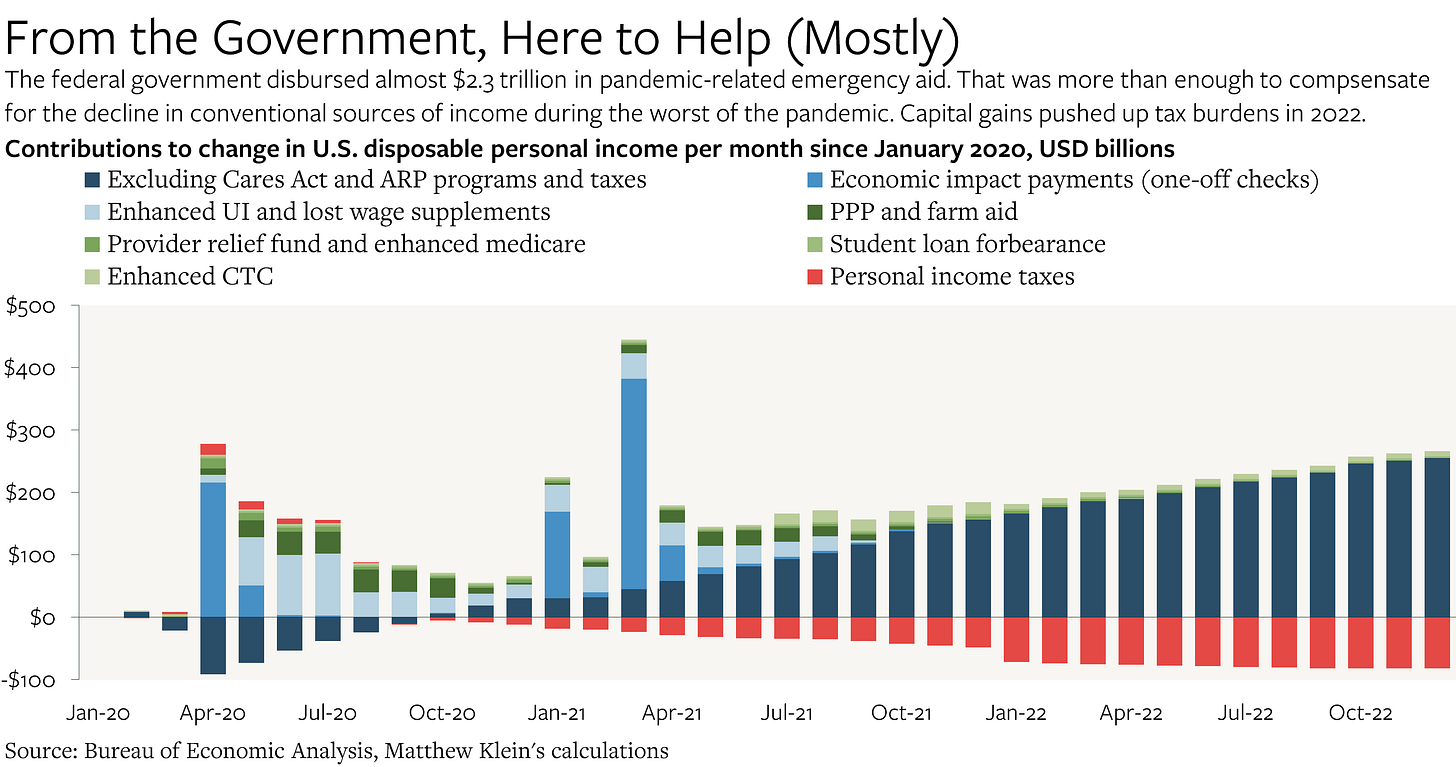

The government’s extraordinary response to the crisis added $2.3 trillion on top. Almost everyone got “economic impact payments”, the tens of millions who lost their jobs got enhanced unemployment benefits and lost wage supplements, many businesses and nonprofits got forgivable “paycheck protection program” (PPP) loans and other subsidies, hospitals received “provider relief funds” at the same time that Medicare upped its reimbursement rates to doctors, and tens of millions of student debtors are still benefiting from interest forbearance. The eviction bans and mortgage forbearance schemes also supported household balance sheets, although the BEA has not published estimates of their impact.