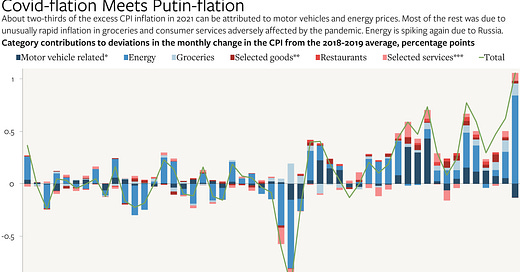

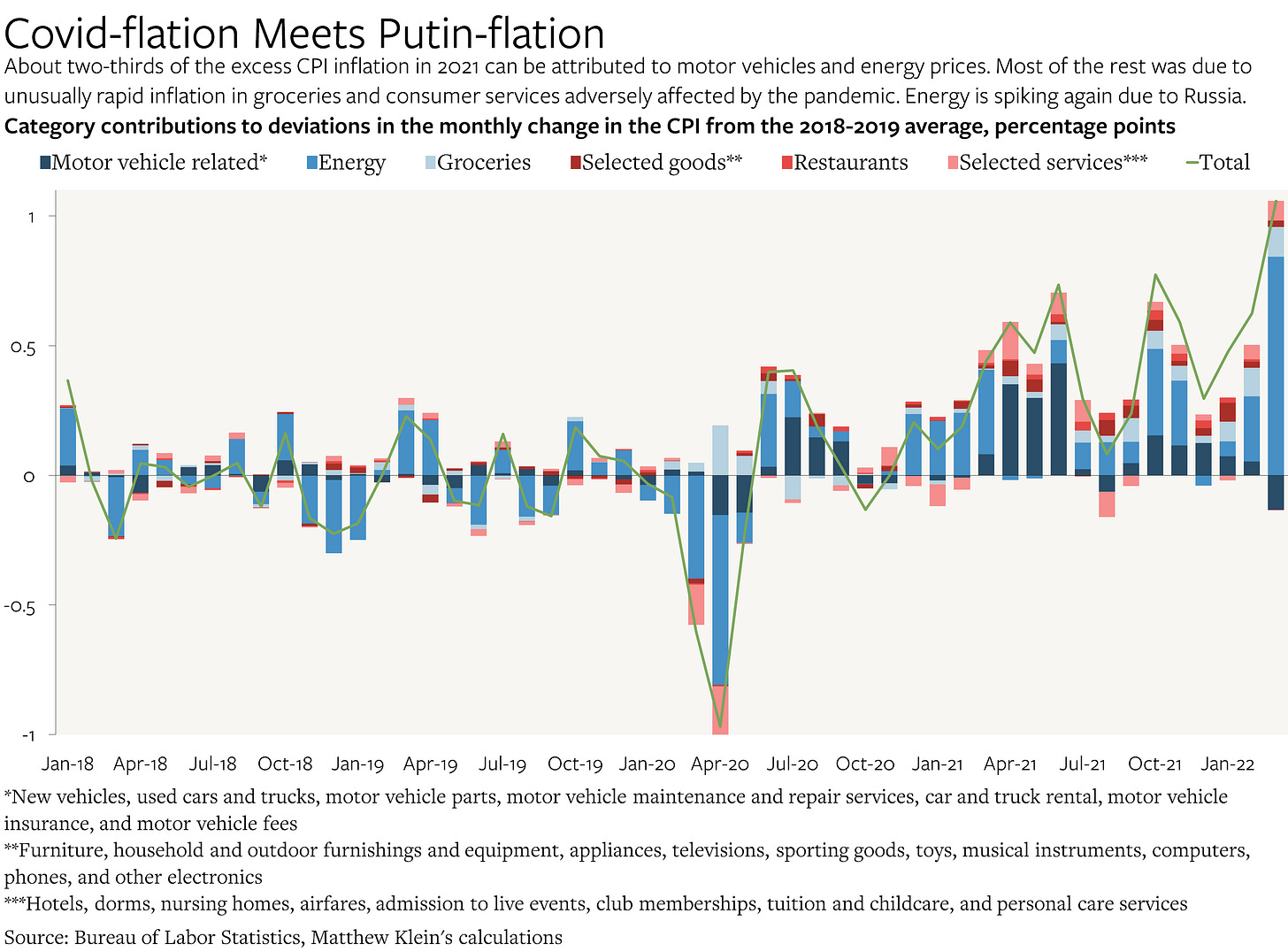

Covid-flation Meets Putin-flation

Domestically-generated U.S. inflation was slowing down in March. But the good news was offset by Russia-related shortages of energy and food. Lockdowns in China will be a wildcard going forward.

U.S. inflation is getting worse, with consumer prices in March 1.2% higher than in February on a seasonally-adjusted basis. That’s the biggest monthly jump since Hurricane Katrina crippled oil refineries near the Gulf of Mexico in August-September 2005 and pushed up gasoline prices by 19% in the space of a week.

But in important respects, the U.S. inflation situation may be improving, with notable monthly slowdowns in the prices of restaurants and housing.

The ultimate outcome will depend on the interaction of three distinct forces:

The commodity shortages caused by Putin’s invasion of Ukraine

The Chinese government’s lockdowns in major productive areas including Shenzhen, Guangzhou, Shanghai, and Beijing

The ongoing normalization of the U.S. economy and resulting moderation of domestically-generated U.S. inflation

This three-way split is new, and it can be traced to two specific developments that began about 7 weeks ago.