Looking at Japan with FT Unhedged

What makes the economy different, and why this (might) make Japanese stocks relatively attractive.

I’ve enjoyed reading the Unhedged newsletter for years. Somehow, Rob Armstrong and Ethan Wu consistently produce must-read market analysis for Financial Times readers every single weekday. (Rob also writes incisive columns about men’s fashion, even if I sometimes feel directly targeted.) So it’s a real treat to be able to collaborate with them for an examination of Japan’s economy and the potential attractions for investors. This piece is jointly available for all subscribers to both The Overshoot and Unhedged. I’ll be publishing some additional analysis and charts on Japan in a subsequent note.

An Economy Apart

Unhedged: As most of the world’s major economies have struggled with waves of pandemic-driven inflation and rapid policy tightening designed to address that inflation, Japan has stood apart. In August, Japanese consumer price inflation rose to 3% y/y. That’s a 30-year high, but officials in the U.S. or Europe can only dream of such a low figure. The Bank of Japan, correspondingly, swims against the global tide, keeping monetary policy loose. The result has been a dizzying fall in the yen:

It is the combination of an economic environment distinct from the rest of the world and a weak currency that drew Unhedged’s attention back to Japan. Surely relatively gentle policy, a currency supportive of exports, and some pent-up post-pandemic demand in Japan and Asia should create investment opportunities in a Japanese market that has been unpopular with global investors in recent years?

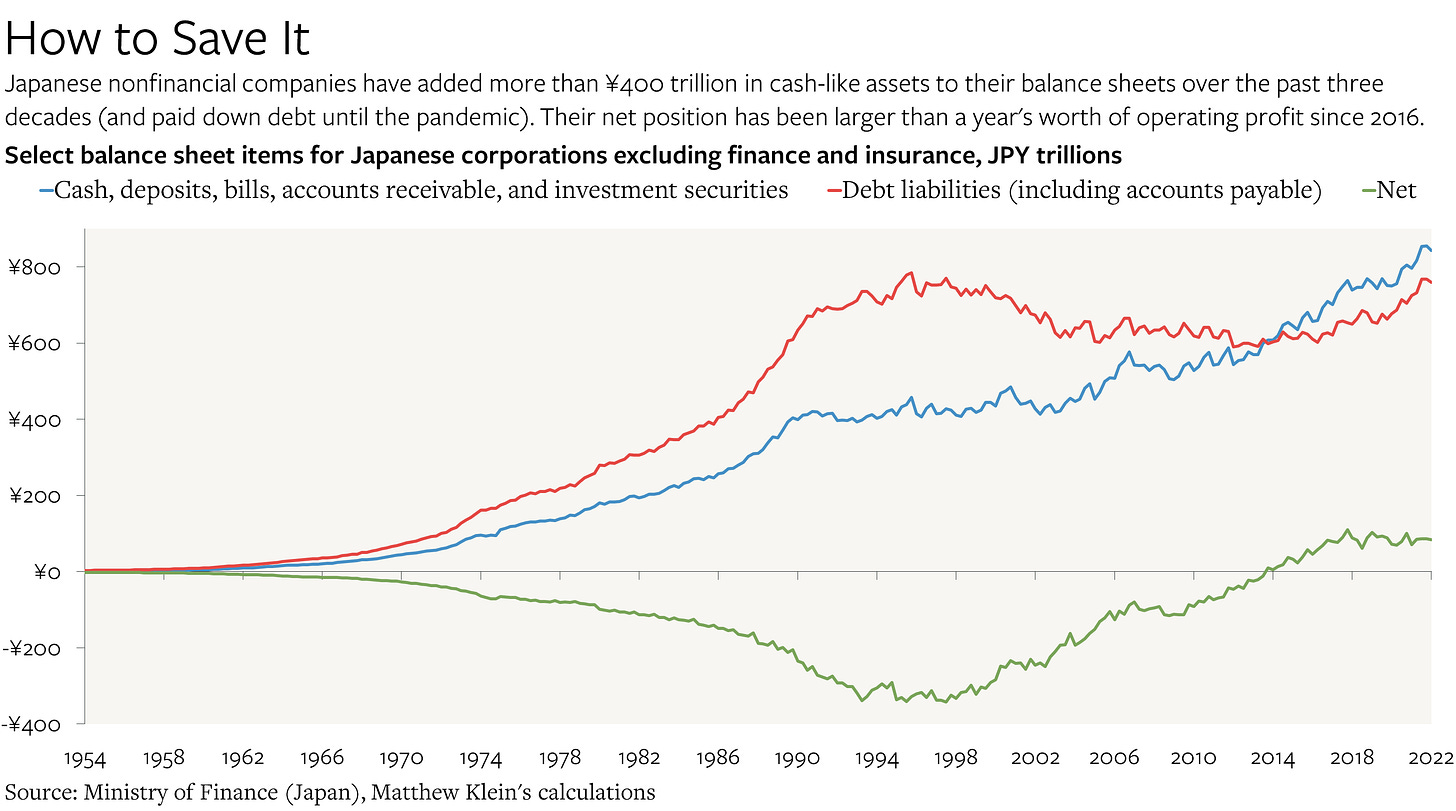

Matt Klein: The thing that really stands out to me is that the 1980s bubble and 1990s bust left a massive permanent mark on the Japanese economy. Corporations went from being massive borrowers that relied on external finance to cover their capital budgets (and some of their operating expenses) to being huge net lenders. Since 1995, debt repayments, cash accumulation, and purchases of other financial assets have added up to more than ¥600tn. The costs of this financial conservatism have been falling business investment and rising precarity for workers.

Shinzo Abe’s economic program was a response to this problem. The hope was that a mixture of carrots (a weaker yen, lower taxes on profitable companies, more pro-business regulations, infrastructure investment) and sticks (inflation, governance reforms, higher taxes on unprofitable companies) would get companies to start spending their cash piles. It didn’t really work, but the upshot is that Japanese companies have ended up with absurdly strong balance sheets.

This balance sheet strength has helped Japanese companies weather the pandemic and also seems to be helping them manage the hit from soaring food and energy prices. It also means that Japan Inc. now responds to changes in global financial conditions in unusual ways. The recent combination of yen depreciation and rising interest rates in the rest of the world meant that net interest income for non-financial companies in 2022Q2 was three times the recent quarterly average, or roughly 35% (!) of operating income.

Meanwhile, net “non-operating income other than net interest income” (no, I don’t know what this is) has also been rising rapidly, up more than 50% since 2019. Add it up and, for better or worse, operating income only accounts for about 60 per cent of total profits right now. Investors worried about the impact of rising financing costs on corporate performance may therefore find Japanese stocks (currency hedged) an intriguing defensive play.

Unhedged: We have heard for a long time that strong Japanese balance sheets would be put to work creating shareholder value. Maybe now is the moment?

Matt: In theory, there is enormous potential for Japanese companies to boost shareholder returns by rejiggering their balance sheets. Dividend yields have ticked up since Abe began pushing for higher shareholder payouts a decade ago, but they are still low. Buybacks may be anathema to executives scarred by the 1990s, but there is no obvious reason why companies operating in a world of zero interest rates should be so conservative with their cash, which is worth about 13 times operating income.

An Unpopular Stock Market (for now)

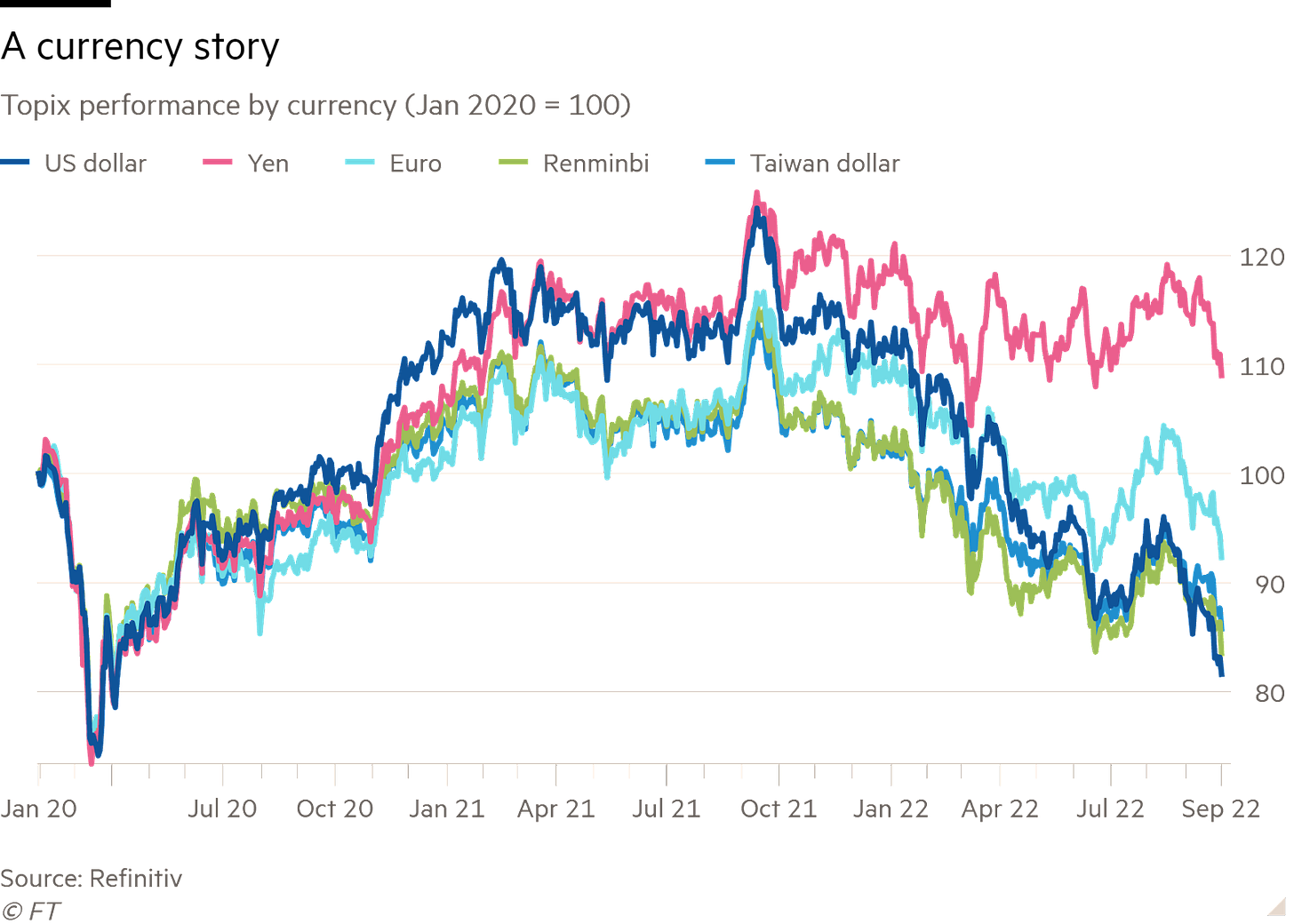

Unhedged: Japanese companies’ balance sheet strength may make them look — in theory — like a haven in the rising-rate storm. So far, though, the Tokyo market remains unloved by international investors. That is understandable: a consequence of the weakening yen is that, measured in global currencies, the Tokyo stock index has performed terribly. From the start of the pandemic in February 2020, the Topix is up 20% in yen terms, but down 7% in dollars, badly trailing US and global indices.

Japan does look cheap compared to other global markets, though the vast discount that opened during the big rally of 2021 — Japanese stocks participated only halfheartedly — has shrunk during the recent sell-off:

Matt Brett manages the Baillie Gifford Japan Trust, which has returned 300 per cent investing in Japanese equities (in pounds) over the past 10 years. He says that recently Japanese growth stocks, in which the Trust specialises, have followed US techs down, with the difference that “the Japanese growth stocks never went up”. Growth companies are trading at 1.3 times sales, he reckons, a “tiny premium” to the Topix at 1.1. Meanwhile, the yield on the stocks in the trust is 2.4 per cent. “As stock pickers, we are quite excited,” he says.

Low valuations and strong balance sheets are a good starting place for investors, but many Japanese companies have struggled in recent quarters. Veteran Japan investor Pelham Smithers of Pelham Smithers Associates lays out the problem as follows:

The basic situation is that one half of Japan is hurt by the weak yen, because of high input costs, but the other half should benefit, so long as they can increase production and distribution abroad. The problem is the country is operating at full employment, and if you order equipment, you take delivery in a few years, so it is hard to take advantage. We saw this in second-quarter earnings, the fact that publicly listed companies, which are tilted to manufacturer and export, saw margins fall . . . both the Auto and electronics sectors saw year over [profit] declines.

The result, Smithers says, is that “Japan is underperforming a weak [global] market,” despite the weak yen and relative economic strength. Importantly, because so many costs are invoiced in dollars, it is yen weakness against the euro and the RMB, not the dollar, that helps the most. But there are reasons for optimism. Japan’s export competitiveness should rise next year as supply chains continue to open, allowing production to expand and margins to recover. Reopening in China, should it happen, would help at the margin too.

A bounceback in foreign visitors may help as well. With travel restrictions set to lift on October 11, tourism and inbound investment should surge, egged on by the weak yen. Matt — how meaningful might this be?

Matt: A big reason why the yen has weakened as much as it has is because Japan has been hit with two separate terms of trade shocks. Japanese rely on imported food and energy, both of which have become scarcer and therefore more expensive. Sustaining those imports means some combination of exporting more and importing less of everything else. Currency depreciation facilitates both types of adjustment. (See also: the U.K.)

At the same time, Japan has lost an important source of hard currency income, although, as you note, this should soon change. The number of foreigners visiting Japan exploded from an average of about 750,000 a year in 2005-2012 to 3.2mn in 2019. Tourism revenues jumped from less than ¥1tn a year to almost ¥5tn in 2019.

The net effect was to push Japan from a large trade deficit in services (including tourism) worth about ¥4.5tn a year to a yearly deficit of less than ¥1tn. Since the pandemic, however, the collapse in visitors (due to Japan’s strict travel restrictions) has pushed the yearly services trade deficit back to about ¥5tn. Even with the spike in commodity prices that’s led to an explosion of the goods trade deficit, the drop in tourism revenue explains about a quarter of the total deterioration of Japan’s trade balance since the end of 2019.

If tourists — and their money — return once Japan reopens, the associated financial inflows could help cover Japanese food and energy bills and support the yen. But there is one big wrinkle: about a third of all foreign visitors to Japan in 2019 came from China, which has its own strict controls on travel. If they don’t come back, tourists from elsewhere would need to fill the gap.

Unhedged: Improving economic, corporate and trade fundamentals won’t help the market, though, if new buyers of securities don’t come to the market. International investors own 30 per cent of the market, mostly in the form of global index funds which are not going to switch to an overweight Japan position. But, again, there is hope. Stronger global investor flows could be attracted to Japan when “ludicrously high” earnings estimates for US and European markets are inevitably cut, making Japan’s valuation edge more apparent, Smithers argues. Domestic demand is more of a challenge: Japanese households are net sellers and the Government Pension Investment Fund (GPIF) has maxed out its domestic equity allocation.

Matt Klein: While there may be good reasons why the GPIF might not want to increase its allocation to Japanese stocks, tweaking the investment mandate would be an effective way for the government to support the yen without changing the monetary stance of the BoJ. Besides, if Japanese stocks are relatively cheap compared to peers (which is at least plausible) the GPIF would be prudent to shift away from assets in other, pricier jurisdictions.

Concluding Thoughts

Unhedged: Summing up, Japan Inc. is cheaply valued, in an excellent financial position and set for both improving export competitiveness and a tourism windfall — all while the BoJ has a shot at slaying deflation. This all seems promising. The problem is that few global investors are much interested, and for good reason. Since the 90s bust, Japan’s sideways markets have burnt many investors who will not be inclined to think this time will be different.

What is different now is that Japan’s weaknesses, demographic and otherwise, seem relatively less severe given that the rest of the world is facing inflation-driven problems that Japan may be in a uniquely strong position to handle.

Does that sound about right to you Matt?

Matt: Yes. For decades, Japan seemed like a country for investors to avoid because it looked stagnant and ultra-conservative. But when much of the rest of the world is dealing with high debt, excessive inflation, and sharply rising interest rates, many of the problems that had afflicted the Japanese economy now look relatively appealing.

Want more from Rob and Ethan? FT premium subscribers can get Unhedged delivered to their inbox Monday - Friday with one click. Or, you can sign up for FT access here.

>"In August, Japanese consumer price inflation rose to 3% y/y. That’s a 30-year high, but officials in the U.S. or Europe can only dream of such a low figure. "

Ahem:

https://twitter.com/asymptosis/status/1575929072202702848