The Fed Is Still Waiting for Supply

Yes, rates are going higher, but the big picture is that the central bank wants businesses and consumers to manage the disruption via higher prices rather than slower growth or higher unemployment.

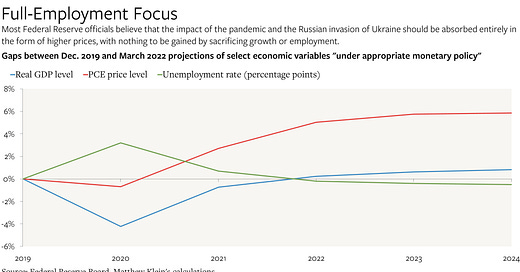

Federal Reserve officials believe that the economic impact of the pandemic and the war in Ukraine should be absorbed almost entirely through higher prices rather than through lower spending. Rightly or wrongly, they remain optimistic that they won’t need to sacrifice growth or jobs to get inflation back on target over the next few years. That’s essentially the same view that Fed officials have had ever since vaccines became available at the end of 2020.

While Fed officials are planning to raise interest rates substantially—possibly by more than what traders believe is appropriate, given the flattening of the yield curve—the current policy trajectory shouldn’t be understood as “hawkish” in any meaningful sense. Far from warning us about an imminent “Volcker moment” in which the central bank deliberately tanks the economy to crush inflation and reset beliefs about future price increases, officials are telling us that they expect the current disruption to fade without much long term damage. No wonder stocks went up.

In their view, higher interest rates will be desirable because the economy is set to return to normal on its own, not because it needs to be forced to slow down. This may turn out to be a mistake, but it seems reasonable given what we currently know and what standard theory implies about optimal policymaking.