The Sanctions' Impact on Russia

Digging into the (limited) data available on domestic production, consumption, credit, and the balance of payments.

Russia’s access to imported goods may have improved somewhat since April, but it would be a mistake to conclude that the country is doing well. By most measures, the sanctions imposed by the allied democracies are inflicting significant damage to Russian businesses and consumers. Data published by the statistical agency Rosstat and by the Bank of Russia depict an economy that is reeling.

Reality is likely even worse than what is shown in the official numbers, which have become increasingly sparse since the invasion began. Over the past six months, the Russian government “temporarily suspends publication” of data on everything from “cross-border transfers of individuals” to energy exports to federal spending to manufactured goods imports. We can only infer how bad things have actually gotten by making educated guesses using the information available.

The Real Economy

Each month, Rosstat publishes a ~300-page PDF on the “Socio-Economic Situation in Russia”. The latest issue came out at the end of July, has data through June 2022, and was the main input to the preliminary estimate of 2022Q2 GDP that was released on August 12. There is also consumer price data through July. The text is only available in Russian, but with the help of Google Translate and my friend Yakov Feygin I was able to get a reasonable sense of what the official data are saying. A few highlights:

As of June, retail spending is down about 10% since the start of the war after accounting for inflation, retailers’ inventories are down about 13% in real terms, and wholesale turnover is down by 20%.

Russian manufacturing of washing machines and refrigerators have plunged by more than 50% since the start of the war. Passenger car assemblies are down by 90%.

Unsurprisingly, the prices of household appliances in Russia have jumped 22% since December 2021, while the prices of new vehicles have jumped 25%. The cost of healthcare and the cost of personal services have jumped almost 20%.

Domestic air travel is down by 83%, while air freight volumes are down by 70%.

Production of electric motors is down about a third. Steam turbine production has ground to a halt. Elevator and excavator output were both 60% lower in June 2022 compared to June 2021.

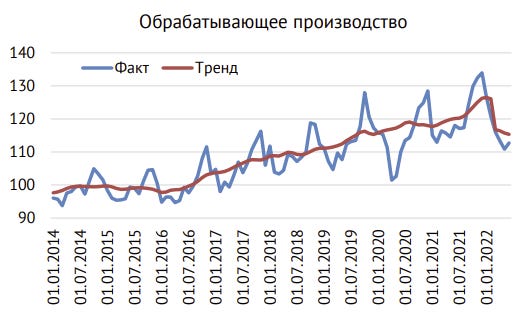

Russia’s Gaidar Institute for Economic Policy estimates that total manufacturing production has dropped about 10% on a seasonally-adjusted basis just since the war started:

As they put it (via Google Translate):

According to the results of the second quarter of 2022, the trend component of the industrial production index showed a decline—mainly due to sanctions imposed by a number of countries after the start of the special operation Russia in Ukraine in February 2022…The logistics of supplies of components and raw materials did not have time to fully reorganize to the domestic market or to the market of countries that have not imposed sanctions against Russia…Following the industrial sectors, there was a decline in other sectors of the Russian economy: cargo transportation due to a reduction in export flows of energy carriers, products of the chemical industry and timber products; wholesale and retail trade due to the departure of foreign firms and the reduction or termination of a number of commodity flows. The construction industry is stagnating due to rising prices for building materials and components. The impact of the imposed sanctions on their production processes is tangible.

Jeffrey A. Sonnenfeld, Steven Tian, Franek Sokolowski, Michal Wyrebkowski, and Mateusz Kasprowicz of Yale’s Chief Executive Leadership Institute believe that Russian oil and gas production is down substantially and that Russian consumer spending has fallen even more than implied by Rosstat. As they put it:

Since Russia’s invasion of Ukraine began in February 2022, the authors have led an intensive research effort to track the responses of nearly 1,500 public and private companies from across the globe, with well over 1,000 companies publicly announcing they are voluntarily curtailing operations in Russia to some degree beyond the bare minimum legally required by international sanctions…These companies, in total, employ Russian local staff of well over 1 million individuals. The value of these companies’ investment in Russia represents the lion’s share of all accumulated, active foreign investment in Russia since the fall of the Soviet Union.

Their assessment is corroborated by Russia’s official balance of payments data.