U.S. Inflation Reprieve?

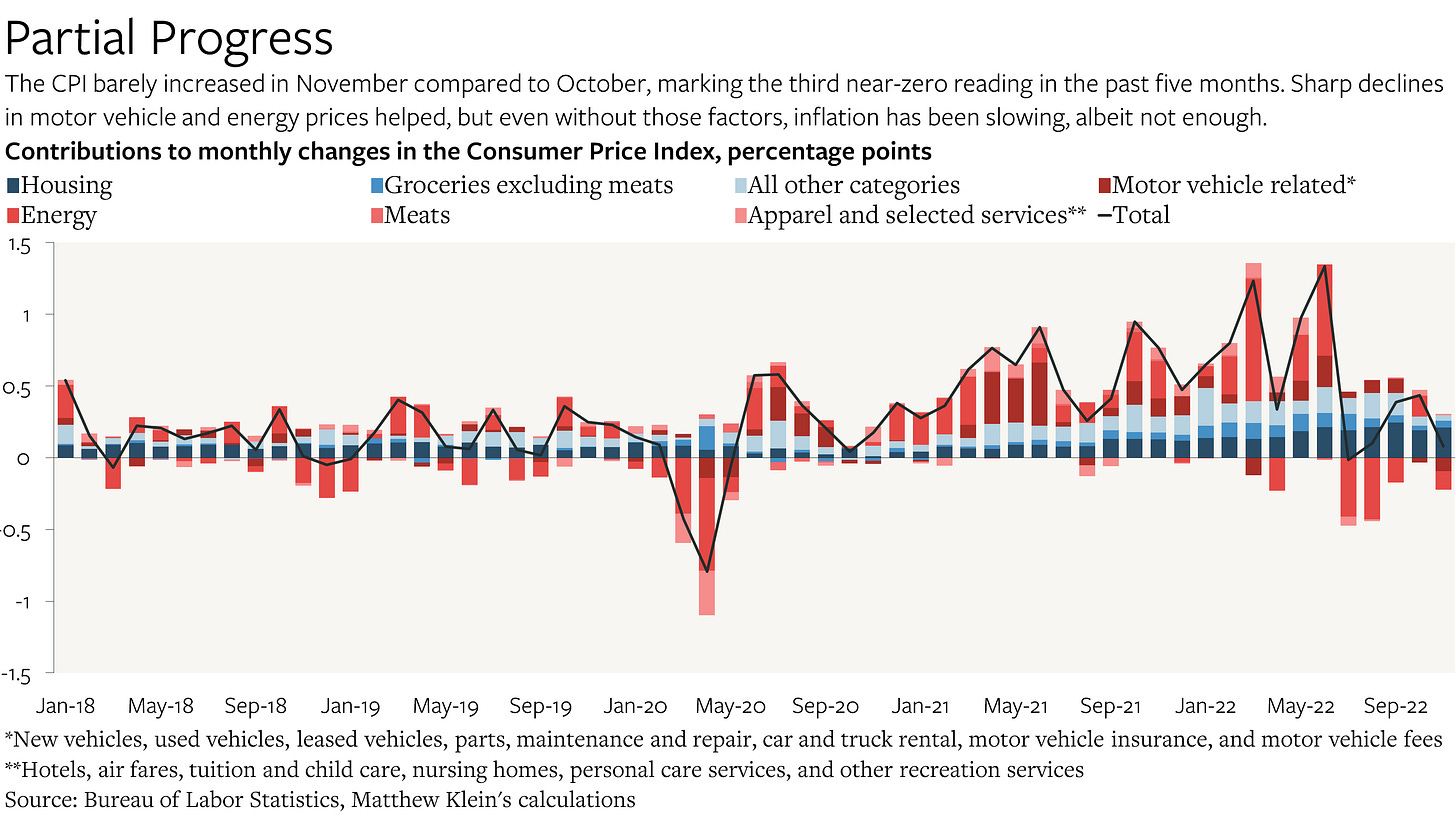

Prices overall rose at the slowest pace since the inflation spike began, even with soaring housing costs. Will it continue?

The Consumer Price Index (CPI) in November was just 0.1% higher than in October on a seasonally-adjusted basis. Since June, the CPI has grown at a yearly rate of just 2.5%.

At first glance, this looks like the post-reopening normalization that optimists had been anticipating for the past 18+ months. But while there are some encouraging signs in the details of the data, it would be premature to conclude that America’s inflation troubles are over. The downturn in energy prices will probably end soon unless there is a severe economic contraction, while the latest Producer Price Index (PPI) numbers suggest that the benefit of falling manufactured goods prices may have already peaked. Overall, the price data are still consistent with the claim that underlying inflation is stabilizing around 4-5% a year—which also happens to be what is implied by the wage data.

Positive Energy

The decline in consumer energy prices—down 11% in November compared to the peak in June—has played a significant role in holding down overall inflation, and this should continue at least into December. Falling energy costs are a boon, but it is unlikely that prices will fall much further than they already have.

Oil prices in particular have been held down by the combination of the Chinese government’s “Covid Zero” policy and U.S. releases of crude from the Strategic Petroleum Reserve (SPR). Chinese refineries processed 5% less crude oil in January-October 2022 than in the first ten months of 2021, reducing global demand by roughly about 30 million tons, or ~224 million barrels. Relative to what might reasonably have been expected based on the pre-pandemic trend, Chinese oil refining in 2022 was down by more than twice as much. Over the same period, the SPR has released just under 200 million barrels of crude oil onto the market.

Both of those deflationary forces are about to reverse—and for good reason. The SPR is ostensibly going to start refilling its salt caverns if prices go any lower than they are right now to stabilize investment and limit future price volatility. And in a remarkable about-face, the Chinese government has decided to remove almost all pandemic controls in what looks like an attempt to achieve herd immunity as quickly as possible. Chinese oil consumption might fall for a few months as everyone gets sick, but the policy turnaround should eventually boost global oil demand as economic activity normalizes.

Given this, the total change in the CPI is probably less relevant as an indicator for the future than the change in the CPI excluding energy.