U.S. Inflation Surged in January. Is It a Fluke?

Prices jumped in many categories in the first month of the year. Some of that may be noise, and should be discounted accordingly, but it is difficult to ignore the breadth of the pop.

American consumer prices popped in January across a range of categories from hospital visits to appliances, sporting goods, home internet, and groceries.

While overall monthly inflation as measured in the Consumer Price Index (CPI) appeared less severe thanks to notable drops in the prices of clothing, gasoline, and—especially—used vehicles, many underlying measures imply that inflation has been accelerating from the relatively slow pace of mid-2023. That would be consistent with the recent data on wages and aggregate nominal spending, which remain persistently faster than before the pandemic.

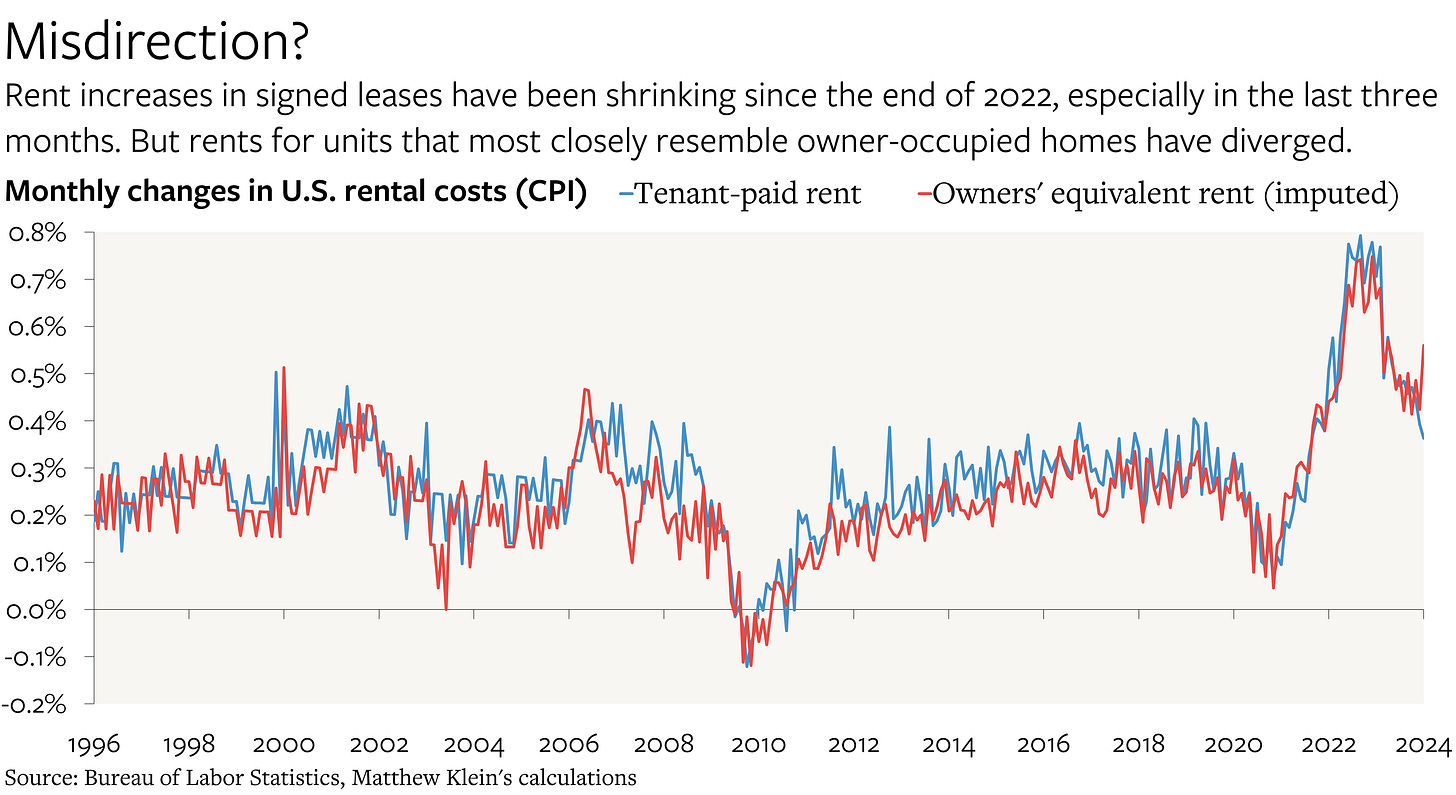

Dissecting the OER Spike

The largest single contributor to January’s excess inflation was the surge in “owners’ equivalent rent” (OER), which rose by 0.6% on a seasonally-adjusted basis. That was an unwelcome surprise for many analysts, and was inconsisent with the slowdown in actual rents paid by tenants. The unusual divergence between the two measures—the largest gap in one-month changes in nearly thirty years—led quite a few to attribute the strength of the January inflation report to what might be a data error. Or, if not an error, at least a one-off that will correct itself in short order.

I am sympathetic to the view that the latest OER print could be misleading. But I also think that this makes no difference to the latest inflation numbers.