Checking in on the U.S. Housing Market

Activity is normalizing along with rates. Builders' prudence on hiring during the boomlet is now shielding the job market.

The pandemic and the associated policy responses inflated house prices across much of the world. The subsequent withdrawal of emergency measures and the end of the one-off work-from-home migration wave have restored normalcy to much of the market. While lower prices and fewer transactions may be unpleasant for realtors and people who panic-bought housing in the past two years, the macroeconomic impact so far appears to minimal. Much of that can be explained by builders’ reluctance to boost hiring during the boomlet, which seems to have given them the flexibility to hold onto workers even as demand normalizes.

Live by Low Rates, Die by High Rates

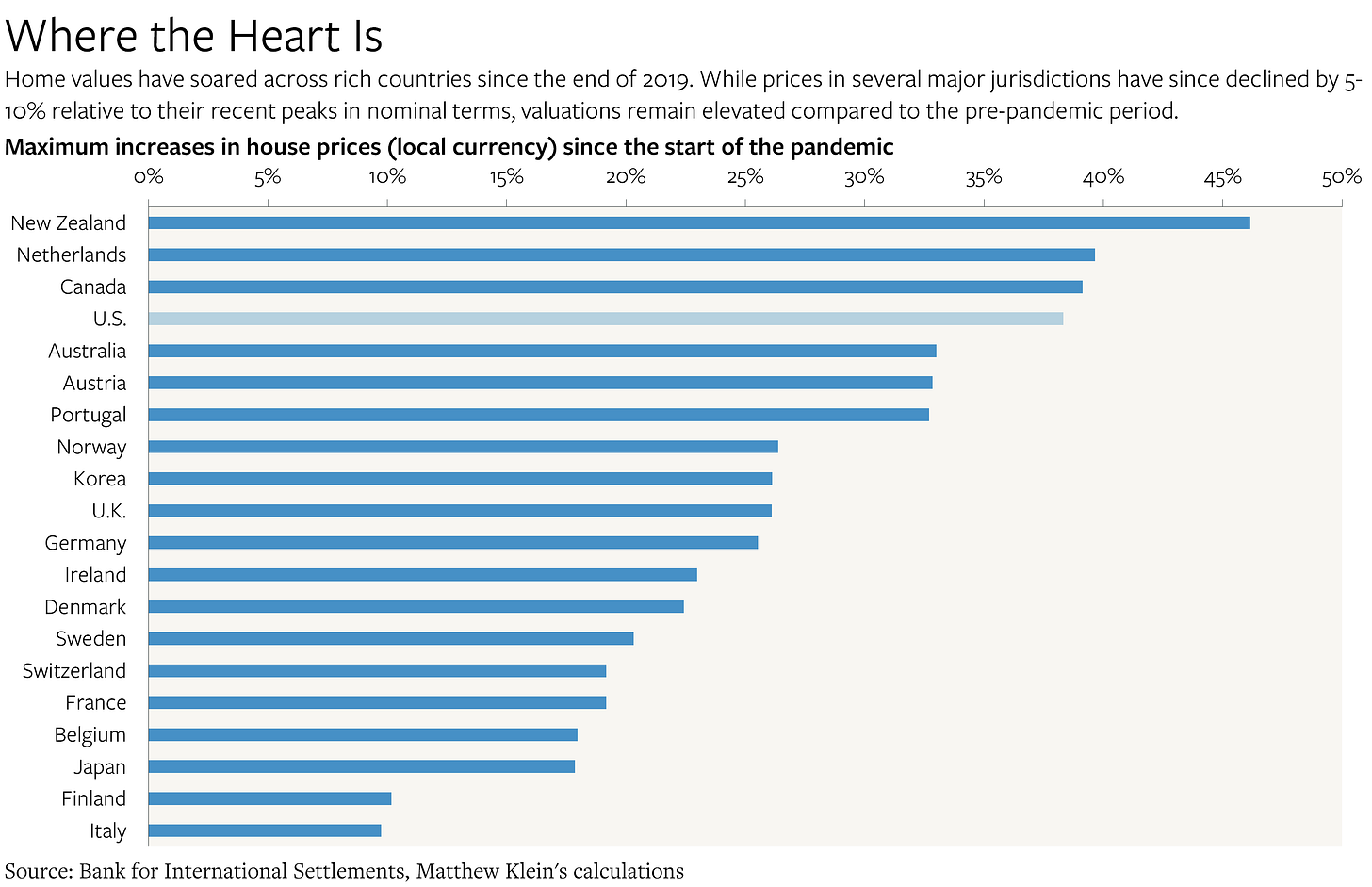

U.S. house prices—like prices in much of the rest of the rich world—surged during the pandemic. Reduced spending on services and government income support meant that consumers had extra disposable income to spend on housing and durable goods. Many workers forced to work from home suddenly found that they needed more space at the same time that they had the flexibility to move. Most importantly, lower mortgage interest rates meant that a given monthly payment could service much larger loans, which inflated purchasing power for owner-occupiers and investors alike.

Globally, the U.S. was not an outlier, although American house price gains were towards the upper end of the distribution.

As real mortgage rates1 rose by 4 percentage points, however, the price action began to go into reverse.

On average, U.S. home values in October-December 2022 were 3% lower than the most recent peak in April-June 2022.2 Many cities have experienced sharper declines. So far, San Francisco and Seattle have been hit hardest, while Chicago, Cleveland, and Detroit have been relatively shielded.