China's Smaller Banks Are Getting Squeezed

PBOC lending to other depository corporations is up by 50% since mid-2022. That coincides with deposit migration away from small and medium sized banks towards the biggest institutions.

The People’s Bank of China (PBOC) has ramped up its lending to the country’s banking system by 50% since mid-2022.1 This may be a response to the migration of business deposits out of smaller commercial banks.

The data available to me are not yet sufficient to explain why these deposits are leaving. It could be that the businesses that banked with smaller and mid-sized banks are facing unusual amounts of stress, or it could be that those businesses are worried about the safety of deposits held outside of the biggest banks. Either way, it is a novel development that is worth tracking for understanding the evolution of the Chinese financial system.

The PBOC’s Changing Balance Sheet

Before 2015, the PBOC held mostly foreign exchange reserves as assets on its balance sheet. Almost $1 trillion of these foreign assets were sold in 2014-2016 to compensate for Chinese capital flight / portfolio diversification / FX debt repayments. The PBOC offset the impact on China’s domestic monetary conditions by lowering the amount of (CNY) reserves that banks needed to hold on deposit at the PBOC and by ramping up its own lending to Chinese banks.

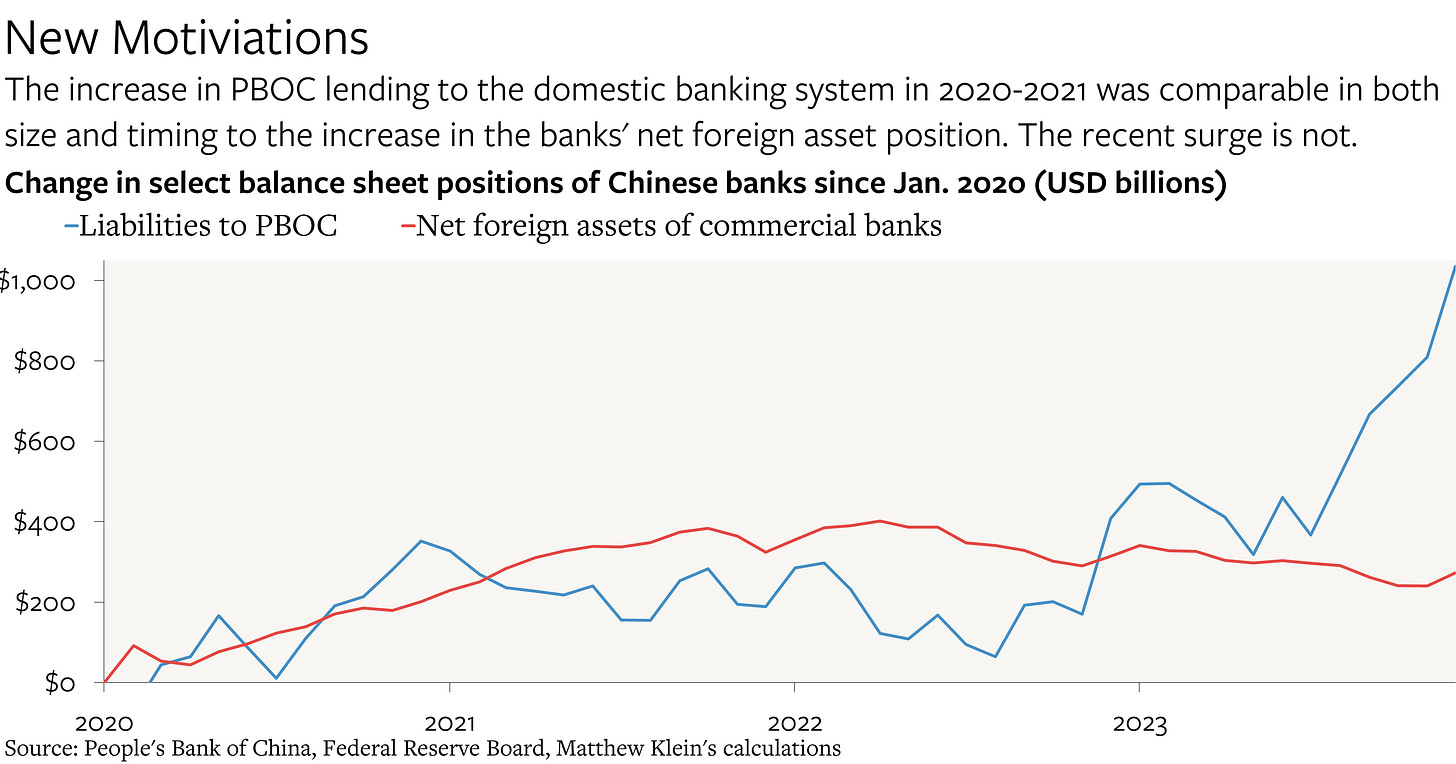

Since the beginning of 2017, the PBOC’s official FX reserves have been mostly flat, while the country has shifted most of its currency management from the central bank to other parts of the state-run banking system. Back in 2021-2022, I had speculated that the PBOC was boosting its CNY lending to the banking system so that those banks could then sell CNY for U.S. dollars and other foreign currencies. The net foreign asset position of “other depository corporations” (ODCs) seemed to rise in line with their borrowing from the PBOC. While that may have been true then, it does not seem to explain what is happening now.