How Credible Is the 2025Q1 GDP Decline?

Inventory accumulation is almost certainly being undercounted. Data center investment may also be undercounted. But there was still a substantial slowdown that could get worse.

It is hard to believe that the U.S. economy can be slowing when aggregate wage income and inflation-adjusted consumer spending are still rising reasonably briskly. Yet the official data suggest that the combination of defense cuts, the unwinding of election-related spending, and a modest decline in construction activity all contributed to a notable slowdown in 2025Q1. The flip side, according to the government’s current estimates, is an unusually large decline in corporate profits, much of which in turn is attributable to a sharp move in the “capital consumption adjustment”. The question is whether this is a fluke or a harbinger of something worse to come.

There are two challenges to answering this.

First, the government seems to have failed to measure a notable chunk of inventory accumulation by businesses, particularly in the pharmaceutical industry, thereby misrepresenting the implied relationship between imports, spending, and domestic production. Whether or not the government eventually finds those inventories, their impact on the economy will show up sooner or later, potentially confounding the statistics in the quarters ahead. Second, the government may also have failed to capture some of the ongoing boom in data center investment by companies that build their own servers out of imported parts and components.

Meanwhile, underlying inflation—before accounting for tariffs—remains stubbornly stuck about 1 percentage point faster than before the pandemic, even as idiosyncratic or mismeasured categories continue to push down the headline rate. The combination of upside risks to prices and downside risks to growth helps explain why monetary policymakers are reluctant to adjust interest rates.

Before we get into any of that, however, a note about imports.

Importing Confusion

When the advance estimate for 2025Q1 growth was first published at the end of April, I ignored it because the headline number was obviously off. Supposedly, there was a surge in imports that was so large relative to the sum of domestic demand (including inventories) and exports that the implied change in domestic production was negative. That was hard to reconcile with the decent-to-solid numbers for retail spending, employment, services revenues, and industrial production, among other things. Having looked more closely at the numbers since the second estimate was published, my conclusion is that some combination of consumer spending, business investment, and (especially) inventory accumulation must have been undercounted. Even so, however, there really does seem to have been a meaningful slowdown in GDP.

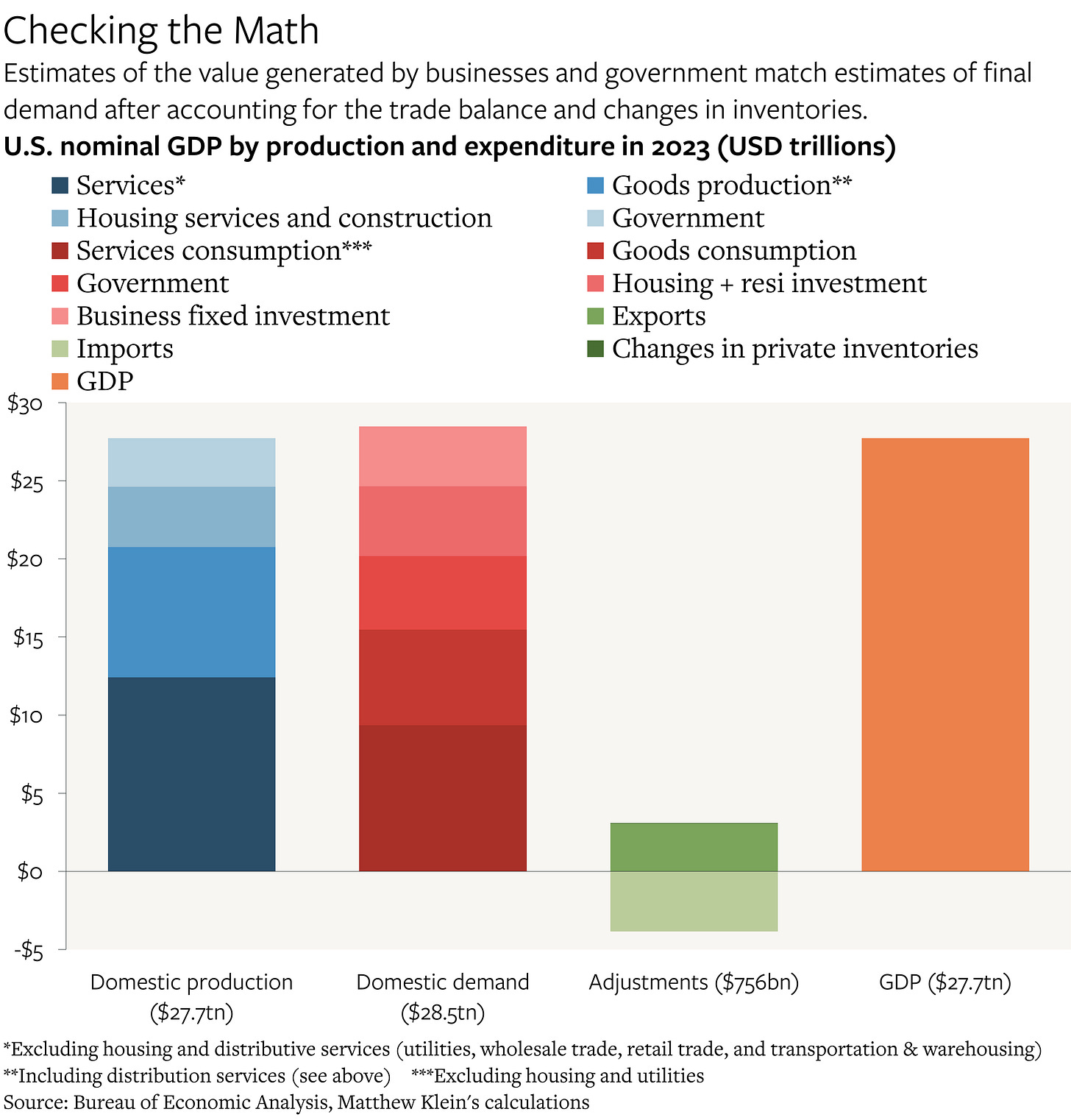

GDP stands for Gross Domestic Product, and each of those words is important for understanding how the aggregate number is put together. The goal is to track production of new goods and services within a given jurisdiction. One way to do this is to measure the value generated by each industry sector and add them all up to get GDP. While the Bureau of Economic Analysis (BEA) does calculate and publish these numbers, it does so with a lag. The short cut is the “expenditure approach”, which is based on the following identity:

Domestic Spending = Domestic Production - Exported Domestic Production + Imported Foreign Production

Or, more conventionally:

GDP = Consumption + Fixed investment + Changes in inventories + Exports - Imports

Spending is used as a proxy for what is actually produced, but that only works if exports are added in and imports are subtracted out to avoid double-counting—and if spending is measured correctly. Otherwise, rising imports would imply that domestic production is falling.

As it happens, U.S. goods imports surged in the first three months of 2025 as businesses and investors stocked up on gold, electronics, and, pharmaceuticals. The value of goods imports in January-March was $948 billion, compared to $848 billion in October-December 2024. Of that $100 billion (12%) increase, about $60 billion can be explained by higher imports of gold bars and other precious metal products (goods included in chapter 71 of the Harmonized System). The remainder is entirely attributable to higher imports of organic chemicals ($27 billion, HS 29) and pharmaceuticals and medical goods ($15 billion, HS 30). Imports in other categories also popped in March, but were relatively lower in January and February, so that the quarter-to-quarter change was effectively zero.

These data are not adjusted for seasonal patterns or for changes in prices, which means that they differ in important ways from the numbers used as inputs to GDP. Even so, according to the BEA, the real volume of U.S. goods imports excluding gold1 increased by 11% on a seasonally-adjusted basis between 2024Q4 and 2025Q1. That is the largest quarterly increase in real non-gold goods imports relative to GDP since the quarterly data begin in 1947 other than 2020Q3, when imports were bouncing back from the trough of the pandemic.

About half of this import surge can be explained by higher volumes of “medicinal, dental, and pharmaceutical preparations, including vitamins”, while the other half of the increase is attributable to “computers, peripherals, and parts” (27%), “other household goods, including cellular telephones” (14%), and “telecommunications equipment” (6%).2

Unfortunately, the BEA’s longer-term estimates of the relationship between changes in import volumes and changes in GDP are not as detailed, but they are still striking.