Most Americans Are Doing Well. For Now.

The latest data on incomes and consumption (for May) suggest that most households were in solid financial shape.

The typical U.S. household earned more than ever as of May—even after accounting for inflation. And their finances were secure, with consumer spending rising at a steady clip even as their saving rate remained elevated.

This is being obscured by the misfortunes of America’s investors, who are being hit by huge tax payments owed on capital gains from 2021, falling asset values so far this year, and ongoing weakness in cash distributions via interest and dividends.

The disconnect between the wellbeing of the vast majority and the discomfort of the few makes it challenging to interpret the aggregate data. But a close reading of the official numbers on income and spending implies that most Americans are doing far better than before the pandemic.

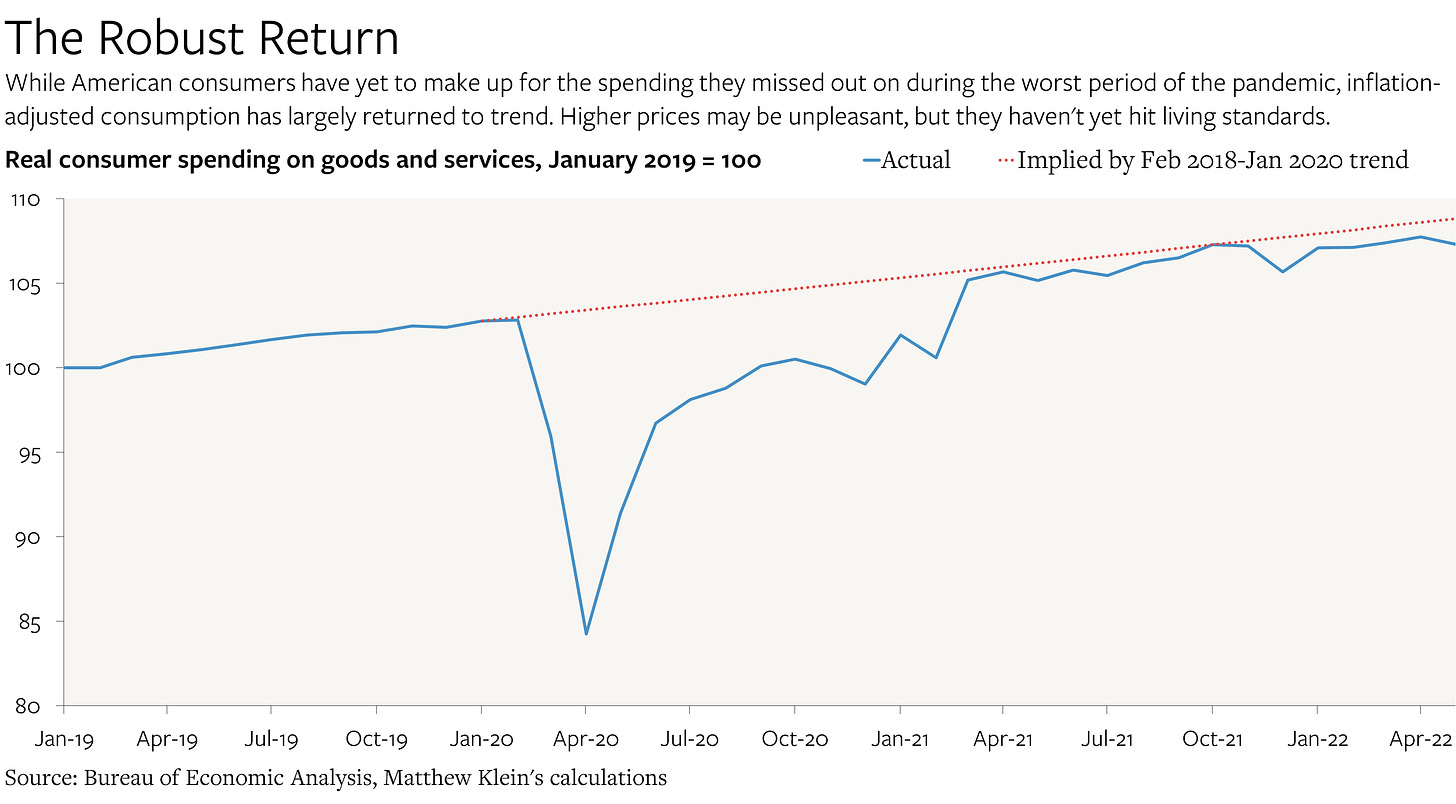

Inflation-Adjusted Spending Remains Largely on Track

Before the pandemic struck, Americans consumed about 2.5% more goods and services each year. The virus knocked things off course, and there was good reason to fear that the damage would be permanent, as is often the case. Remarkably, that’s not what happened this time. By March 2021, real consumer spending had largely returned to the pre-pandemic trend. Americans haven’t yet made up for the ~$1 trillion in spending that they missed out on, but they are doing far better than they did after the global financial crisis.

This is all the more impressive considering how much the mix of spending has shifted over the past few years. Things are steadily normalizing, but even now, price-adjusted spending on groceries and durable goods (cars, appliances, furniture, exercise equipment, televisions, etc) remains elevated, while real spending on consumer services such as movie theaters and dental visits remains depressed.

Whether this spending is sustainable depends on how it’s being financed. And here there is more good news—if you dig closely into the data.