Russia Sanctions Update: April (comprehensive) and May (preliminary)

Data indicate that the Putin regime remained under pressure as of May.

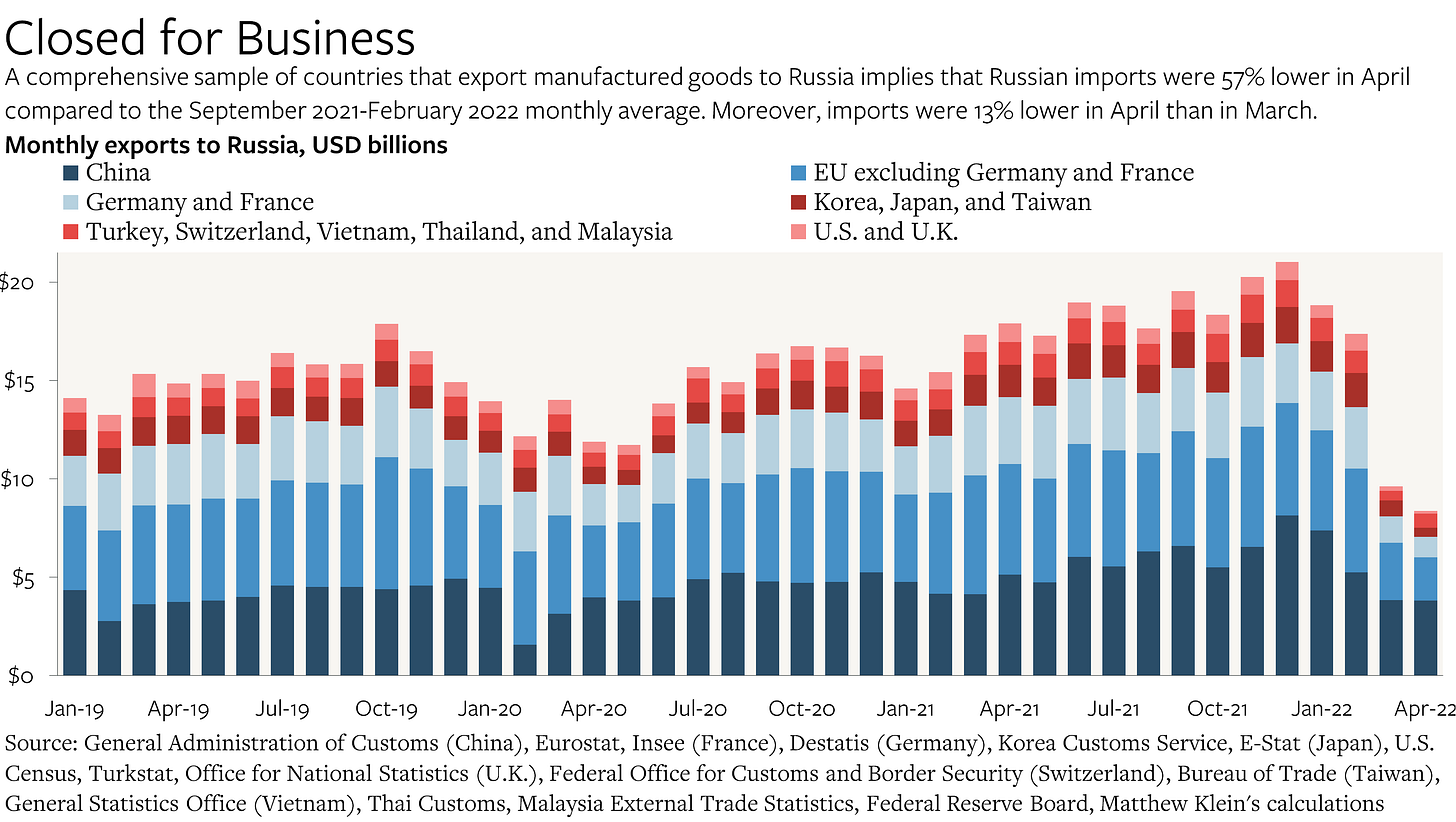

Russia remains starved of imports from much of the world.

The longer it remains cut off from access to parts and equipment from the major manufacturing countries, the harder it will be for the Russian military to replace any tanks, missiles, ships, aircraft, and other weapons systems lost in battle. Simply maintaining its existing stock of materiel will prove more and more challenging. The costs for the Russian civilian economy will also be increasingly dire as ordinary consumers lose access to new cars, appliances, and domestic air travel.

While these measures are unlikely to be decisive by themselves, the persistent degradation of Russia’s military and industrial capacity should, alongside ongoing allied arms deliveries to Ukraine, make a meaningful contribution to the war effort.

Reverse-Engineering Russian Import Data

I have been tracking the impact of the sanctions on Russian imports since April. (My previous installment can be found here.) As regular readers know, the challenge is that the Russian government “temporarily suspend[ed] monthly publication” of the country’s trade data. Fortunately, there is a straightforward, albeit time-consuming, solution: look at the export data from Russia’s trading partners. By definition, everything imported by Russian residents is exported from somewhere else. I have created a sample of 39 countries that accounted for about 70% of Russia’s pre-war imports—and the overwhelming majority of its imports of advanced manufactured goods and other inputs with military applications.1

We have data on all 39 countries in my sample through the end of April. Despite soaring export revenues thanks to high commodity prices, the U.S. dollar value of Russian imports was 57% lower in April 2022 compared to the September 2021-February 2022 monthly average.

Moreover, the declines in exports to Russia were broad-based. Imports from the allied democracies fell by 66% vs. the pre-invasion average, while imports from the rest of the sample fell by 42%.