The U.S. Economy Is Booming (For Now). What Does It Mean?

Every measure of activity indicates remarkable resilience in the face of "restrictive" monetary policy. That is good for many people, but may be trouble for some bond investors.

Federal Reserve officials keep saying that “monetary policy is restrictive”, but at least a few of them seem to be having some doubts.

They are right to be skeptical. It is at least as plausible that current policy is actually closer to “neutral” thanks to persistent changes in the income distribution, private sector balance sheets, and fiscal policy over the past few years. The available evidence from both the real and financial sides of the economy suggests that policymakers should be thinking harder about how they will respond if spending continues to grow substantially faster than they believe is sustainable. Even if they refrain from raising short-term interest rates much more, these pressures may make them equally unwilling to lower interest rates any time soon.

Broken Transmission?

The standard line among academics and central bankers is that there are “long and variable lags” that separate the short-term interest rates the Fed directly controls from the financial conditions that affect consumer and business behavior; that separate changes in those financial conditions to decisions about borrowing, spending, and saving; and that separate those decisions from hiring, investment, and inflation outcomes that we actually care about.

As it happens, the Fed only began raising short-term interest rates at the end of March 2022, and short rates did not cross 4% until December 2022. The Fed only started running down its portfolio of Treasury bonds and mortgage-backed securities last June, and it wasn’t until last fall that the runoff hit its full stride. Even now, the Fed’s securities holdings are still substantially larger, relative to U.S. national income, than at any point since before the start of the pandemic. That could explain why the hard data on economic activity, which tend to move last, are still implying vigorous underlying strength (more on that below).

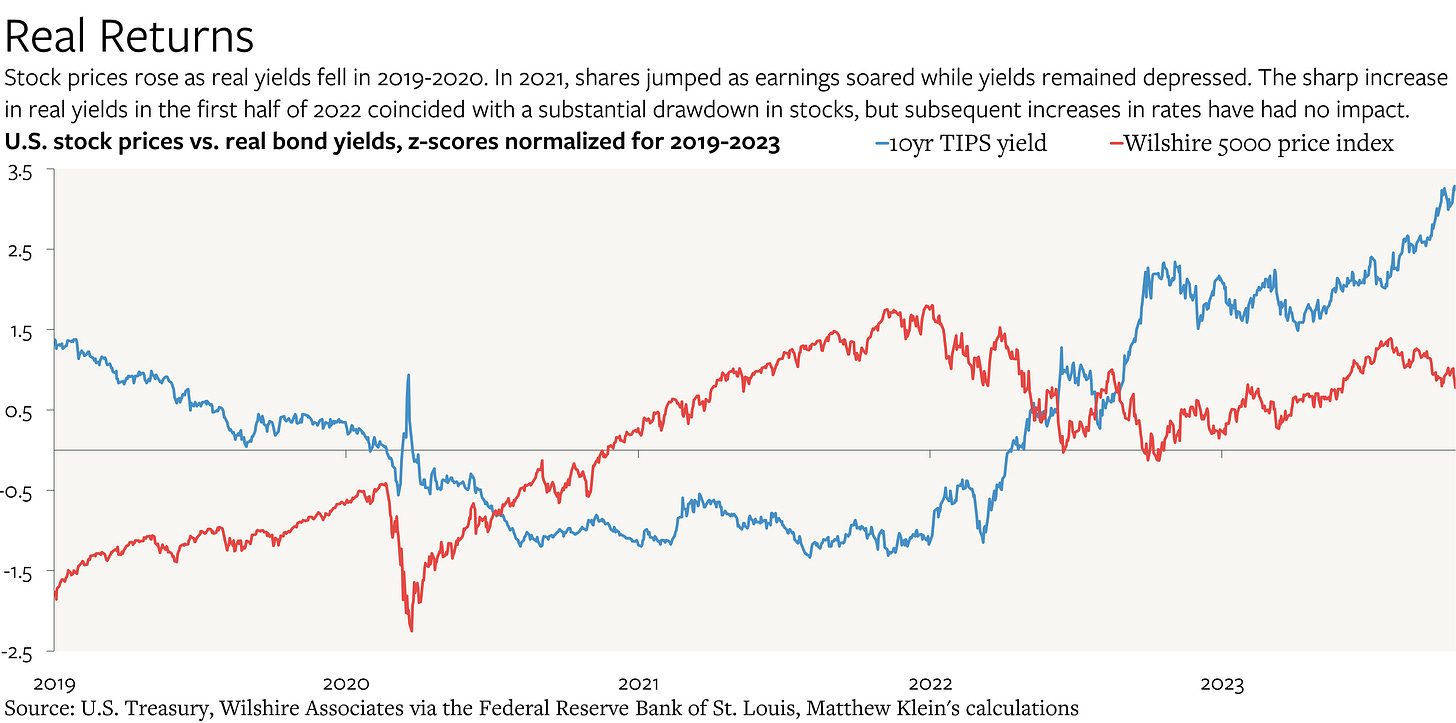

The problem with this argument is that financial conditions have not actually tightened. The Fed itself pointed this out in its latest Financial Stability Report, published on October 20.1 They said that stocks are expensive—especially relative to bonds—that credit spreads are tight, and that “property prices remain elevated relative to fundamentals”. The price of Bitcoin has doubled year-to-date, while Ethereum is up by ~50%.

Put another way, the uptick in default-free discount rates has been more than offset by a substantial decline in the risk premiums available on assets relative to cash.

This helps explain why consumer and corporate borrowing is still roughly in line with pre-pandemic norms.