What's going on with interest rates? (Part 1)

Making sense of the recent wild ride in the front end, with a special focus on the expiration of Australia's yield target

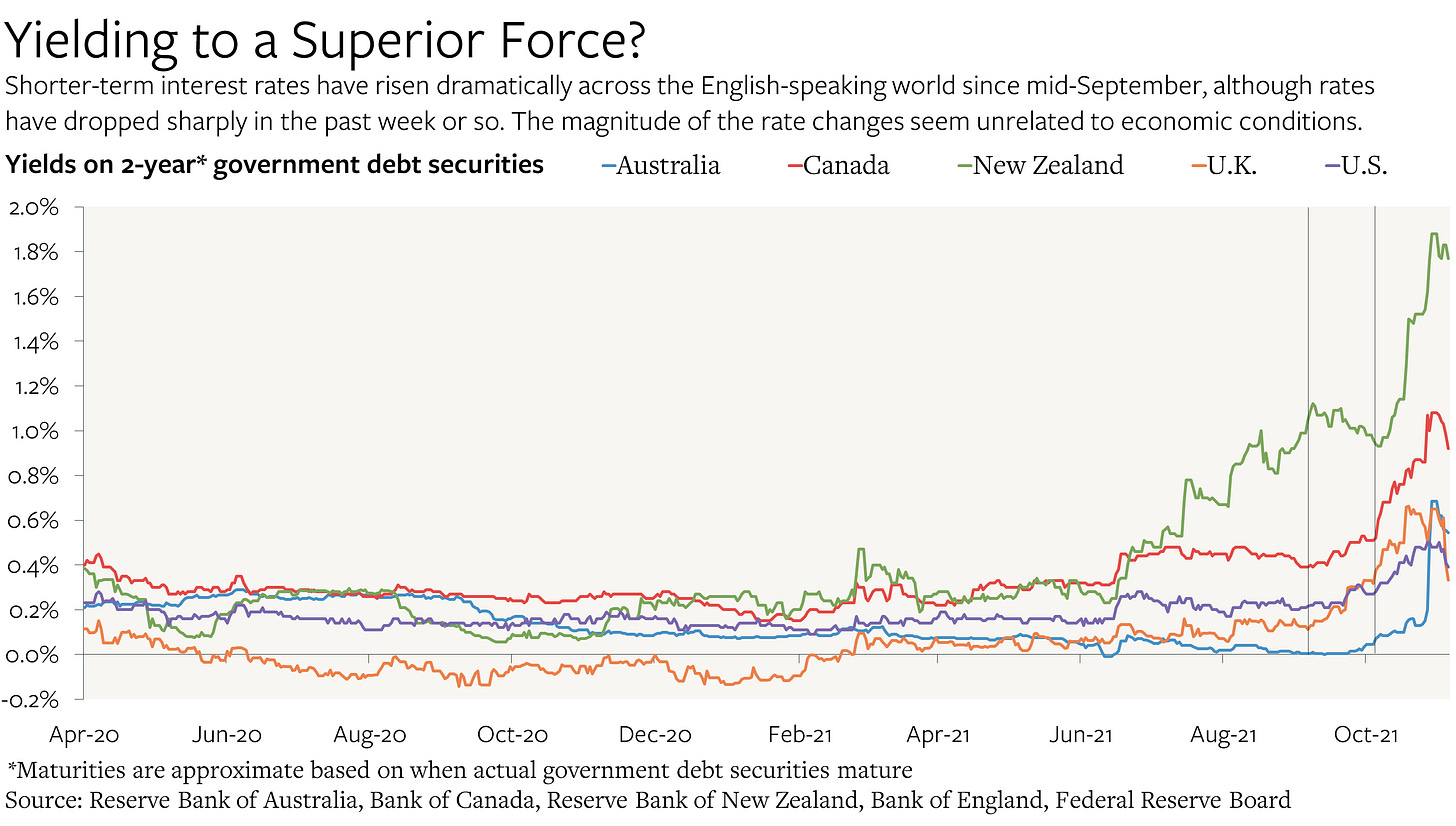

Shorter-term interest rates soared from the Antipodes to the Arctic between mid-September and the beginning of November, with traders betting on much more rapid monetary tightening across the rich English-speaking countries over the next couple of years than they were just a few weeks earlier. Since then, rates have plunged by the most in a week-long stretch since the start of the pandemic.1

What does this tell us about how traders are thinking about the monetary policy outlook? What does it mean for central banks? And what does it mean for the global economy more generally?

While the specific answers vary across countries, there are a few conclusions we can tentatively draw:

The data over the past few months may be pushing at least some of the Anglosphere central banks to revise their assessments of both local and global economic conditions, and therefore their estimates of when they should begin “removing accommodation” (raising rates)

Traders have been betting that at least some of these central banks are overreacting, which may have persuaded at least some of those central bankers to hold off raising rates

Some major players in shorter-term interest rate markets may have been forced to close out their positions as prices moved against them, which has probably exacerbated the violence of the recent moves

Either way, the relative levels of interest rates in each economy seem increasingly disconnected from their relative underlying fundamentals, which may present some trading opportunities for those able to bear the risk