Whither Globalization? And What Would that Even Mean, Anyway?

Before getting worried about U.S.-led "deglobalization" or "fragmentation", it helps to have some context about what has already happened.

This year’s World Economic Forum at Davos opened with a panel featuring a few Overshoot readers on “De-Globalization or Re-Globalization?”. Around the same time, a team of 13 economists at the International Monetary Fund (IMF) published a paper on “Geo-Economic Fragmentation and the Future of Multilateralism”. Afterwards, Adam Tooze wrote a longer piece elaborating the arguments he made at Davos while also responding to the IMF paper.

I was not at Davos, but I did have a chance to present a paper of my own at a recent conference in D.C. on the subject of “Decoupling: Where Are We Now?” My goal was to provide context about what had already happened to inform analysis about where we might be going. What follows is a version of some of the points I made then, as well as a few responses to some of the claims made by others.

For many casual observers, 2016 marked the start of a shift towards global economic and financial disintegration. That was the year that the British voted to leave the European Union and the year that Donald Trump won the presidency after campaigning against open trade (among other things). Sensing an opportunity to seize the initiative, Xi Jinping went to Davos in January 2017 and claimed that China was ready to be the new champion of “economic globalization”:

All countries enjoy the right to development. At the same time, they should view their own interests in a broader context and refrain from pursuing them at the expense of others. We should commit ourselves to growing an open global economy to share opportunities and interests through opening-up and achieve win-win outcomes. One should not just retreat to the harbor when encountering a storm, for this will never get us to the other shore of the ocean.

We must redouble efforts to develop global connectivity to enable all countries to achieve inter-connected growth and share prosperity. We must remain committed to developing global free trade and investment, promote trade and investment liberalization and facilitation through opening-up and say no to protectionism. Pursuing protectionism is like locking oneself in a dark room. While wind and rain may be kept outside, that dark room will also block light and air. No one will emerge as a winner in a trade war.

Western news accounts of the speech were remarkably credulous, although the New York Times at least called out the Chinese government’s violent resistance to outside cultural, social, and political influences after the first dozen paragraphs regurgitating the economic message.

In the years that followed—all the way up until now, apparently—the consensus has been that Chinese leaders believe in globalization because the ongoing process of globalization has been good for China.

From this perspective, the U.S. has been the prime agent of de-globalization in recent years, first under Trump but especially now under Biden with the domestic content requirements of the Inflation Reduction Act and the squeeze on China’s indigenous semiconductor industry.1 Americans, according to this interpretation, have realized that they dislike what the open trading system has produced, and are now trying to unmake the world they had spent decades building.

As Tooze put it: “to hold this view [that globalization is not under threat] you have, in fact, to believe many things, chief among them being that the Biden administration does not mean what it says.”

I want to present an alternative narrative based on a few key points:

For the world as a whole, economic and financial integration peaked around 2008, but this global average masks major differences among countries

In practice, China has been the main champion of deglobalization, decreasing its reliance on imports from the rest of the world, while curtailing the relative importance of the rest of the world as an export market

Despite this, China’s own rapid growth has ensured that the rest of the world has been becoming increasingly reliant on imports from China and increasingly reliant on China as an export market even as China itself deglobalizes

From this perspective, the recent shift in U.S. policy looks more like a desire for reciprocity more than anything else

Collectively, the rich democracies are far more integrated with each other than they are with China—and are an overwhelmingly large economic bloc versus the rest of the world

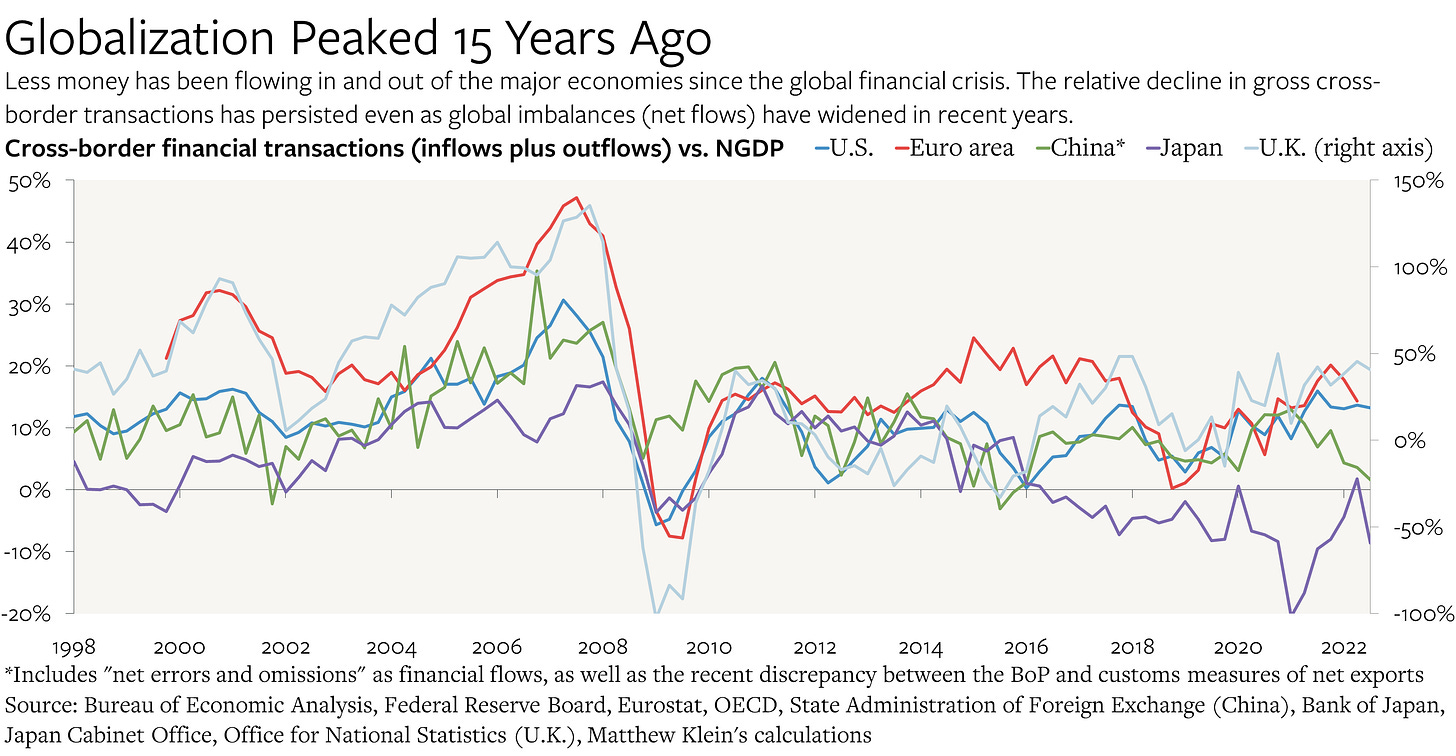

The first point should be well-known, but is worth reemphasizing. There had been a multidecade trend towards greater integration following the end of World War II that accelerated after the fall of the Berlin Wall—but that trend broke at the time of the financial crisis.

While the total volume of cross-border exchange has not declined outright, the proportion of global production that is traded across borders has yet to surpass the 2008 high.

Meanwhile, the absolute sum of gross international financial transactions has been much lower relative to national income in all of the major economies since 2007-8. Investors and bankers pulled back from the types of borrowing and lending that had explained much of the growth in cross-border financial transactions in the face of steep losses and tighter regulatory requirements.

But the story of stagnation in global trade integration needs an important qualification: for many large economies, entanglement with the rest of the world has increased. That was offset, however, by massive changes within China, which rapidly de-globalized since 2007 even as its share of global output tripled.

While some of those changes were essentially benign and determined by Chinese domestic priorities, others reflect deliberate efforts to replace imports with domestic production at the expense of producers in the rest of the world.