Make sense of the global economy

Real-time macro tracking of the biggest countries and currency areas

Data-driven deep dives into global trade and financial flows, macroeconomic balance sheets, demographics, and more

Premium data visualizations, with the option to download the underlying source spreadsheets

Market analysis that ties together the macro and policy analyses with asset price developments

Timely columns on global policy questions

About me

My work is read across the world by central bankers, chief economists, academics, policymakers, and investors.

I won the 2014 Eppy Award for “Best Online Infographics on a Website with 1 million unique monthly visitors and over” for my examination of U.S. mortality statistics and I won the 2021 Lionel Gelber Prize for my book Trade Wars Are Class Wars: How Rising Inequality Distorts the Global Economy and Threatens International Peace (Yale, 2020) with Michael Pettis.

I ended up in this field thanks to an internship doing global macro investment research at Bridgewater Associates in the summer of 2008. Once I started seeing how the world economy fit together, I was hooked and wanted to know more.

Then the financial crisis hit. That event—and its aftermath—made it clear how we are all affected by forces most of us never see or understand. It’s been my mission in life ever since to figure out the interlocking systems of trade and finance that cause bubbles, busts, and everything in between.

I ended up moving to the Council on Foreign Relations to research economic and financial history. After a couple of years there I got my first journalism job, which was an internship at the Economist. From there I moved to Bloomberg, the Financial Times, and most recently Barron’s, where I was the Economics Commentator.

I am proud to present The Overshoot, a subscription-supported publication focused on the intersection of economics, finance, business, and public policy.

What readers are saying

“Matthew Klein’s writing on economics and finance is consistently informed, penetrating, lucid and entertaining. Quite simply, he is a superb economic journalist. Read and enjoy.”

—Martin Wolf, Chief Economics Commentator at the Financial Times

“[Matthew Klein is one] of the most astute commentators on the global economy.”

—Adam Tooze, Professor of History at Columbia University and author of Wages of Destruction, The Deluge, Crashed, and Shutdown

“Matt Klein is one of the keenest observers of economic and market developments out there. What I appreciate most about his approach is the strong seam of economic analysis that runs through the commentary, and the ability to join the dots. His recent book Trade Wars are Class Wars is a tour de force.”

—Hyun Song Shin, Economic Adviser and Head of Research at the Bank for International Settlements

“Every piece Matthew Klein writes is informative, analytical, original, insightful and often provocative. Sometimes Klein persuades me, other times he shakes my confidence in something I had previously thought, but every time I walk away from his pieces smarter about the wide range of economic issues he writes about.”

—Jason Furman, former Chairman of the Council of Economic Advisers and Professor of the Practice of Economic Policy at Harvard

“Matthew Klein has great insights and understanding about how open economies really work. I am looking forward to following him in his new endeavour.”

—Vítor Constâncio, former Vice President of the European Central Bank and former Governor of the Bank of Portugal

“Matthew Klein is one of those writers you just have to follow if you want to understand what’s happening in the world of finance and economics. He brings a global perspective to most issues, making his writing essential reading across geographic boundaries.”

—Stephanie Kelton, Professor of Economics and Public Policy at Stony Brook University, former Chief Economist on the U.S. Senate Budget Committee, and author of The Deficit Myth

“Whether it’s a book on trade wars and class wars, an in-depth piece about the plumbing of the financial system, or a column on economic policy, if it’s by Matt Klein, I’ll read it. Matt has been covering finance and economics like no one, moving back and forth between covering the little details to the big picture as required by the topic and audience at hand. Nothing’s more important for a writer than freedom of form—at The Overshoot, Matt offers his Alphavillian depths and his Barronesque precision, and I want his missives in my inbox to read with my espresso.”

—Zoltan Pozsar, Global Head of Short-Term Interest Rate Strategy at Credit Suisse

“Matt Klein combines deep knowledge of economics, finance, and markets with an amazing ability to communicate his insights. He knows how to sift through the day-to-day avalanche of information to find the gems that can help us make sense of the world. Matt finds the right balance between forest and trees, a balance that few others strike as well as he does. His writings are in my must-read category.”

—Amir Sufi, Professor of Economics and Public Policy at the University of Chicago Booth School of Business and co-author of House of Debt

“Matt’s unique understanding of the interplay between economics, policy, and markets is an invaluable source of insight to navigate financial markets.”

—Angel Ubide, Head of Economic Research for Global Fixed Income at a diversified financial institution and author of The Paradox of Risk

“Matthew Klein has a clear-headed, non-ideological understanding of macroeconomics and markets and expresses his ideas in simple, elegant prose. I rely on his writings and opinions every day as I seek to process what’s going on in markets.”

—Dan Rasmussen, Founder of Verdad Advisers

“Matt Klein has an amazing ability to meld fast-paced economic data analysis with a deep sense of theory and history. When news breaks—whether it be an employment report, a new bill, or a central bank decision—Matt is a must-read for helping me understand what’s going on.”

—Joe Weisenthal, Executive Editor of News for Bloomberg Digital and the Co-anchor of “What’d You Miss?” as well as Bloomberg’s “Odd Lots” podcast.

Why subscribe?

The Overshoot is an essential resource for anyone interested in how financial markets, business, and politics all fit together in the context of the global system.

Most readers will want an individual subscription. It guarantees access to all articles, charts, and group discussions—plus emails directly to your inbox so you never have to worry about missing anything.

In addition to the features mentioned at the top, paid subscribers can also expect to get:

Detailed central bank policy analyses

A massive discount to UN/BALANCED, my podcast with Michael Pettis

Occasional essays on big topics such as how to read and understand major economic datasets, the intersection of finance and philosophy, and principles for economic policymaking

First looks at my upcoming book projects

Summaries and reviews of new economic and financial research from academia and institutions, interviews with leading thinkers—and more.

An individual subscription is $30/month. Annual subscriptions are $330, which means you get one month free. Paying for a subscription ensures that you will never see ads and that your personal information will never be sold to third parties.

Businesses and other institutions can get one-on-one access to me and to my underlying data by purchasing a sufficient number of licenses. Current institutional clients include central banks, family offices, insurers, hedge funds, and investment banks. For more information on the benefits of an institutional subscription and whether it’s right for you, please email me at mck@theovershoot.co.

Why “The Overshoot”?

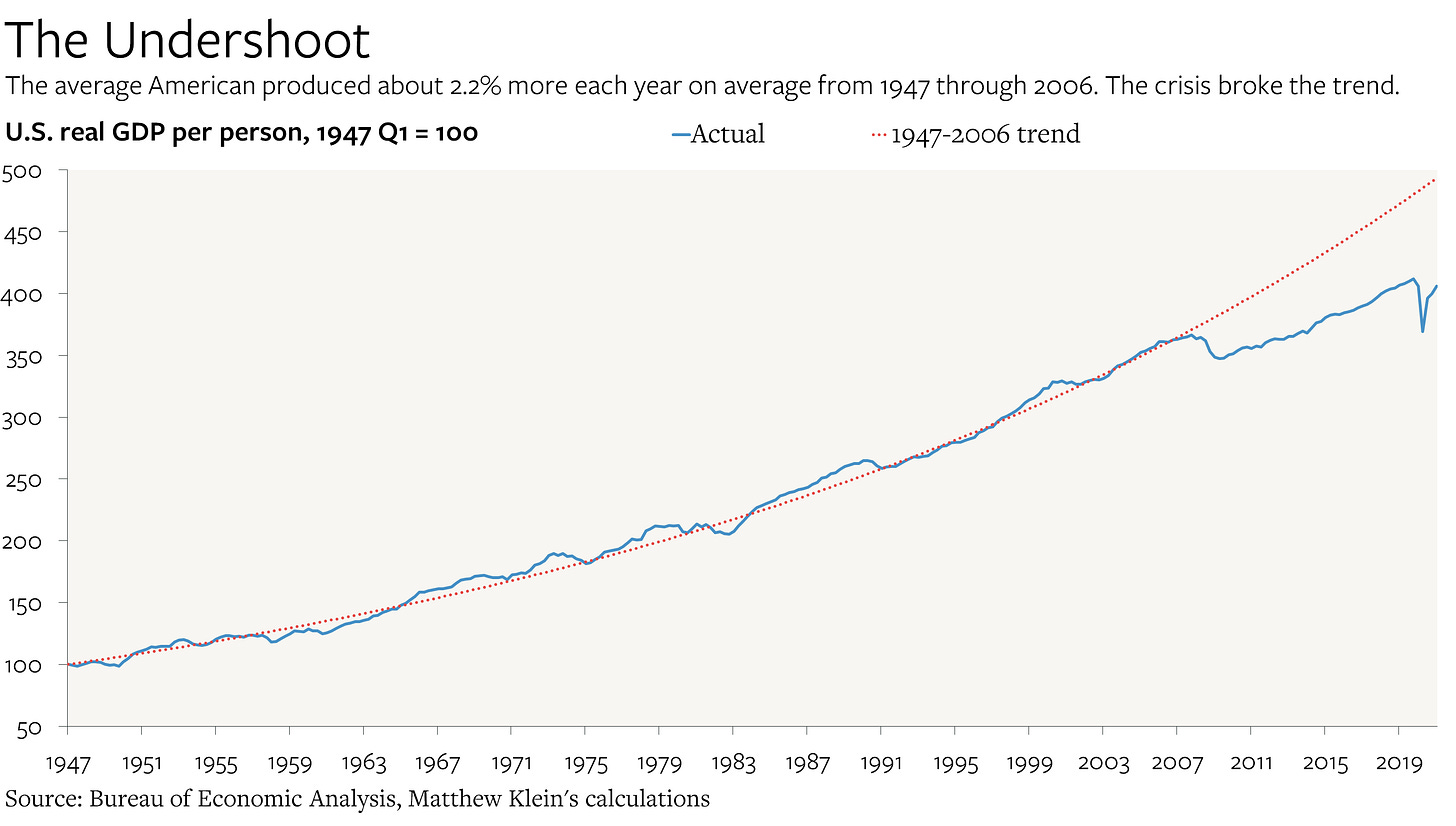

We have been living below our means for a long time. While there are several reasons for this, I think the biggest one was a failure by policymakers to try hard enough. That was the undershoot.

As I explained in my first piece on this site, I think we should aim to do something better—or at least different. In other words, we should overshoot.

More about me

This is an interview I did in May 2021 with Steve Paikin of TV Ontario to talk about Trade Wars Are Class Wars:

I am available for speaking engagements. Please contact Chartwell Speakers for more information.

Below are a few representative samples of my work from Barron’s and the Financial Times:

On the Crisis and Inflation, Barron’s Shows How the Past Can Be Prologue (Barron’s, June 10, 2021)

Inflation Is in the CPI of the Beholder. The Fed’s Favored Gauge, PCE, Explains Its Policy Stance. (Barron’s, May 28, 2021)

Behind the Plot Hole In the Fed’s Forecasts: Big Productivity Gains (Barron’s, March 19, 2021)

The Global Recovery Is Made in the U.S.A. We’re Better Off for It. (Barron’s, March 12, 2021)

Americans Are Sitting On Lots of Spare Cash. It May Not Boost Growth Much. (Barron’s, February 26, 2021)

U.S. Minimum Wages Have Already Jumped—With Minimal Costs to Business (Barron’s, February 12, 2021)

China’s Economy Did Well in 2020. The U.S. Economy Did Not, but It’s Better Off. Here’s Why. (Barron’s, January 20, 2021)

Moore’s Law Is Ending. Here’s What That Means for Investors and the Economy. (Barron’s, November 13, 2020)

The American Dream: Bringing Factories Back to the U.S. (Barron’s, October 9, 2020)

The Fed’s Major Policy Shift (Barron’s, September 20, 2020)

Shinzo Abe Had Big Ambitions for Japan. Here Is Where ‘Abenomics’ Succeeded and Failed. (Barron’s, September 2, 2020)

The Case for Permanent Wartime Economics [book review] (Barron’s, June 5, 2020)

There’s Little to Fear From China’s ‘Rise.’ Why the U.S. Will Probably Prevail in the Long Run. (Barron’s, May 29, 2020)

Don’t ‘Reopen’ the Economy. Don’t Let It Crash. Put It on Ice. (Barron’s, March 27, 2020)

The Economic Case for Paternity Leave (Barron’s, October 25, 2019)

Yes, the Fed Has Cut Rates. No, It Hasn’t Become Dovish. (Barron’s, September 20, 2019)

Blame Argentina’s Economic Crisis on Repeated Mistakes (Barron’s, September 13, 2019)

Everything You Need to Know About Modern Monetary Theory (Barron’s, June 7, 2019)

Italy Embraces China, and Europe’s Elites Have Only Themselves to Blame (Barron’s, April 5, 2019)

China’s Slowdown Is Worse Than You Thought (Barron’s, March 15, 2019)

How Millennials Could Restore American Prosperity (Barron’s, February 8, 2019)

Tariffs and the Minimum Wage Are More Alike Than You Think (Barron’s, December 6, 2018)

The New Case for a Bigger Welfare State (Barron’s, November 22, 2018)

Governments Should Be Run More Like Businesses (Barron’s, October 12, 2018)

What China Is Really Doing With the Yuan (Barron’s, October 11, 2018)

Turkey’s Crisis Was Years in the Making (Barron’s, August 15, 2018)

Tariffs Are the Wrong Response to China (Barron’s, June 22, 2018)

How Tax Avoidance Distorts U.S. Trade and Investment (Barron’s, May 25, 2018)

The euro area’s fiscal position makes no sense (Financial Times, March 14, 2018)

Why mortgage convexity will matter to bond investors again (Financial Times, September 29, 2017)

For the love of Zeus, stop misusing Thucydides (Financial Times, June 27, 2017)

Least productive sectors only thing keeping inflation going (Financial Times, September 12, 2016)

Do demographics dictate lower returns to capital and faster inflation? (Financial Times, January 15, 2016)

The Fed may be about to atone for the “mistake” of 1998 (Financial Times, December 15, 1998)

The euro was pointless (Financial Times, November 11, 2015)

If you’ve made it this far, I hope you consider subscribing!