Inflation Is Still Hot, But Could Incomes Be Slowing?

There is not much reason to be comforted by the latest numbers on prices, but income growth may be slowing.

The January jump in the Consumer Price Index (CPI) was not a fluke. Prices of imported goods and input costs also ticked up in January at the fastest pace in well over a year, while inventories have been either flat or falling relative to sales.1

Yet there are reasons to be optimistic that underlying inflation in 2024 may be slower than in 2023, even if it could continue rising faster than it did before the pandemic.

The latest comprehensive estimates of actual wages earned across the U.S. based on taxes paid into unemployment insurance coverage suggest that both average and aggregate wage growth has slowed dramatically in 2024. And while the January personal income numbers imply that the average American got a substantial pay bump, with personal income before transfers rising at a 9% annualized rate, that seems to be driven by a surge in dividend payouts that is unlikely to finance much, if any, consumer spending.

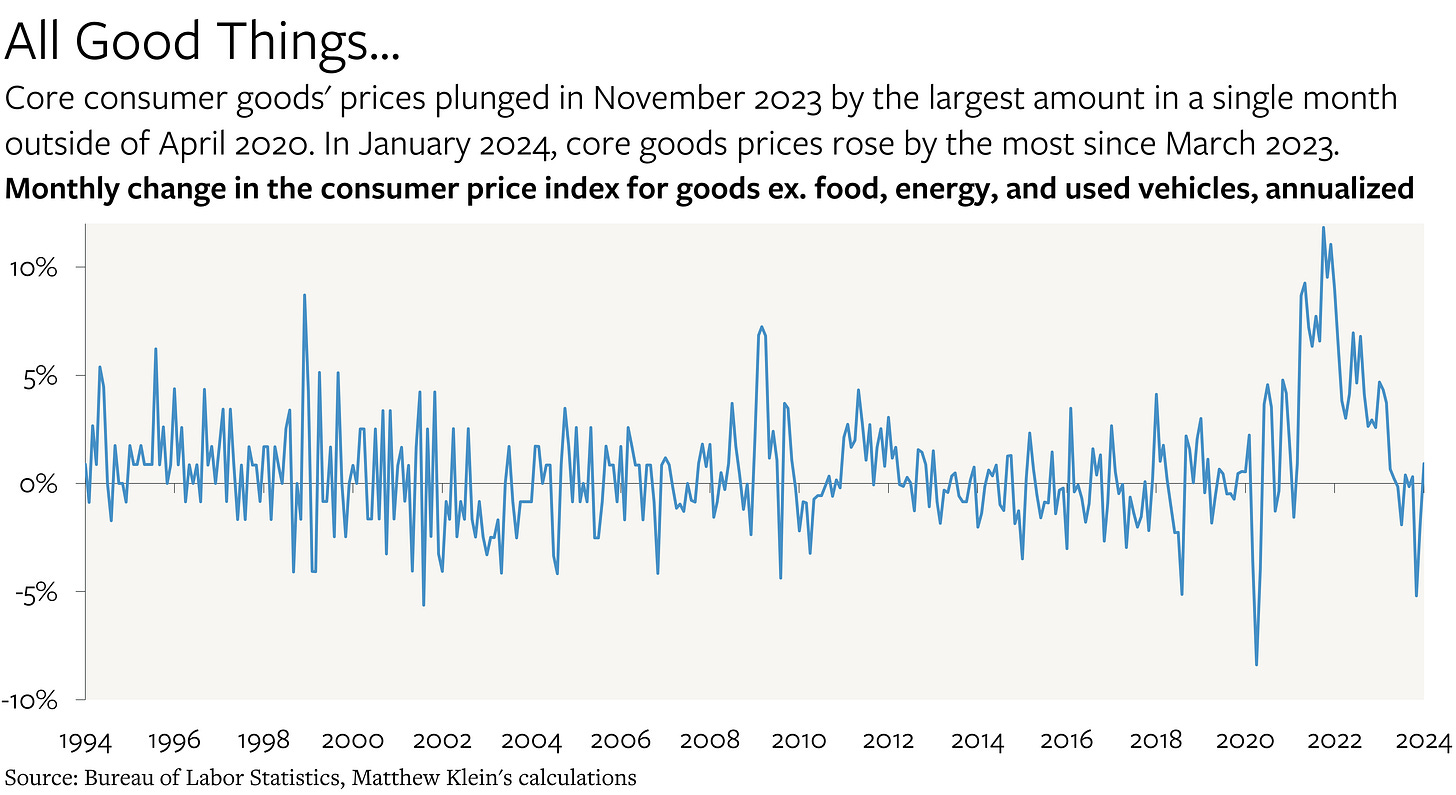

The Bad News on Goods

If the latest data are to be believed, the disinflationary impulse of stable (or falling) prices of manufactured goods may have reversed into an inflationary impulse. The CPI already showed that core goods prices rose in January by the most since early 2023.

The Producer Price Index (PPI) organizes prices of goods and services based on their position in the flow of production from raw materials to finished output. To make a new truck, for example, the first step is to mine the iron and coal (stage 1) needed to make steel (stage 2) that is then forged into the chassis (stage 3) before the finished vehicle is assembled (stage 4). The inputs in each stage are further organized by industry type.

The chart below shows the monthly changes in the prices of goods—other than food and energy—used as inputs to production. Before the pandemic, there was essentially no long-term trend to physical input prices, although there was month-to-month volatility, especially for goods in stages 1 and 2. The pandemic featured a sustained period of rising costs until mid-2022. Since then, there have been two notable periods of falling prices (mid-2022 and mid-2023) with prices otherwise flat. The past few months look a little different, with rising prices across most stages. Stage 3 core goods prices rose in January 2024 by the most since May 2022.