The Overshoot turns 1 (month)

A roundup of everything that's happened with The Overshoot since launching

The Overshoot launched at the beginning of July. I’ve been busy ever since keeping subscribers informed about what’s happening in the global economy. This is your very first

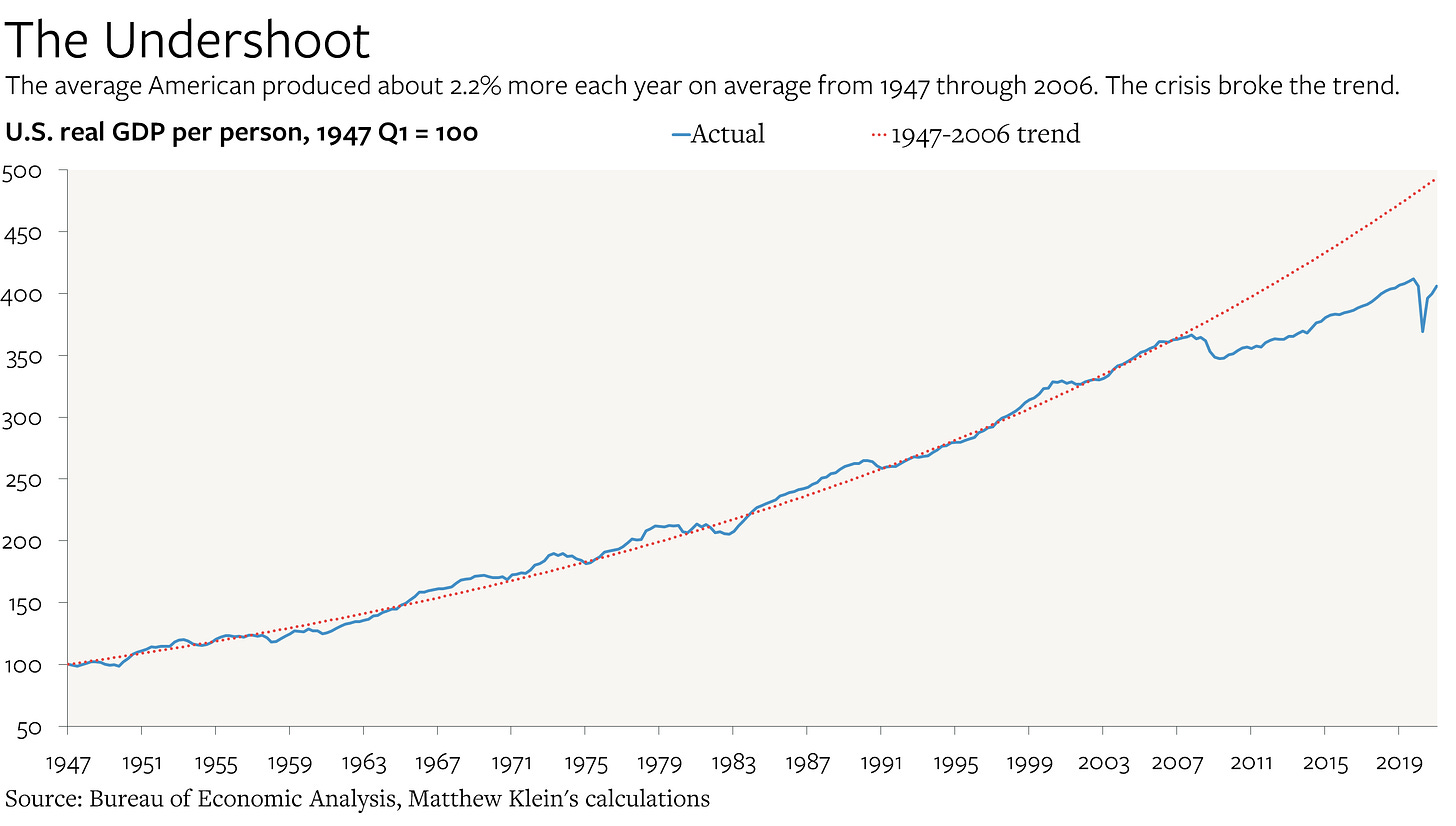

I started off by discussing the unprecedented slowdown in global growth following the financial crisis.

That was followed by my impressions of the U.S. jobs data for June, which included this surprising observation about the apparent changes in the relative productivity of dentists and restaurant workers.

Then I turned my attention to the debate over the Federal Reserve’s purchases of mortgage bonds and their relation to the broader housing market. After explaining how mortgage bonds work and why the Fed buys them, I concluded that critics of MBS purchases—both inside and outside the Fed—were missing the point that mortgage bonds backed by Fannie Mae, Freddie Mac, and Ginnie Mae have zero credit risk. Instead, the value of the Fed’s purchases comes from the impact on the interest rate hedging behaviors of everyone else.

The problem, if you want to call it that, is that housing is extremely sensitive to interest rates. Anything the Fed does, no matter how “conventional”, is going to have an outsized impact on housing. But while the central bank is limited in its ability to target individual economic sectors, the effective nationalization of the U.S. mortgage finance system since 2008 means that the federal government has what I called a “laser scalpel” to target excesses in the housing market, should that be a policy goal.

Next, I took readers inside America’s household savings boom. The pandemic crushed consumer spending even as the government disbursed trillions in aid to support incomes. Looking at a range of data, including the Fed’s detailed breakdown of household assets and liabilities by income, as well as America’s historical experience in the 1940s, I came to the conclusion that “the U.S. household saving boom should help sustain the current expansion—but it probably won’t fuel a post-pandemic spending binge.”

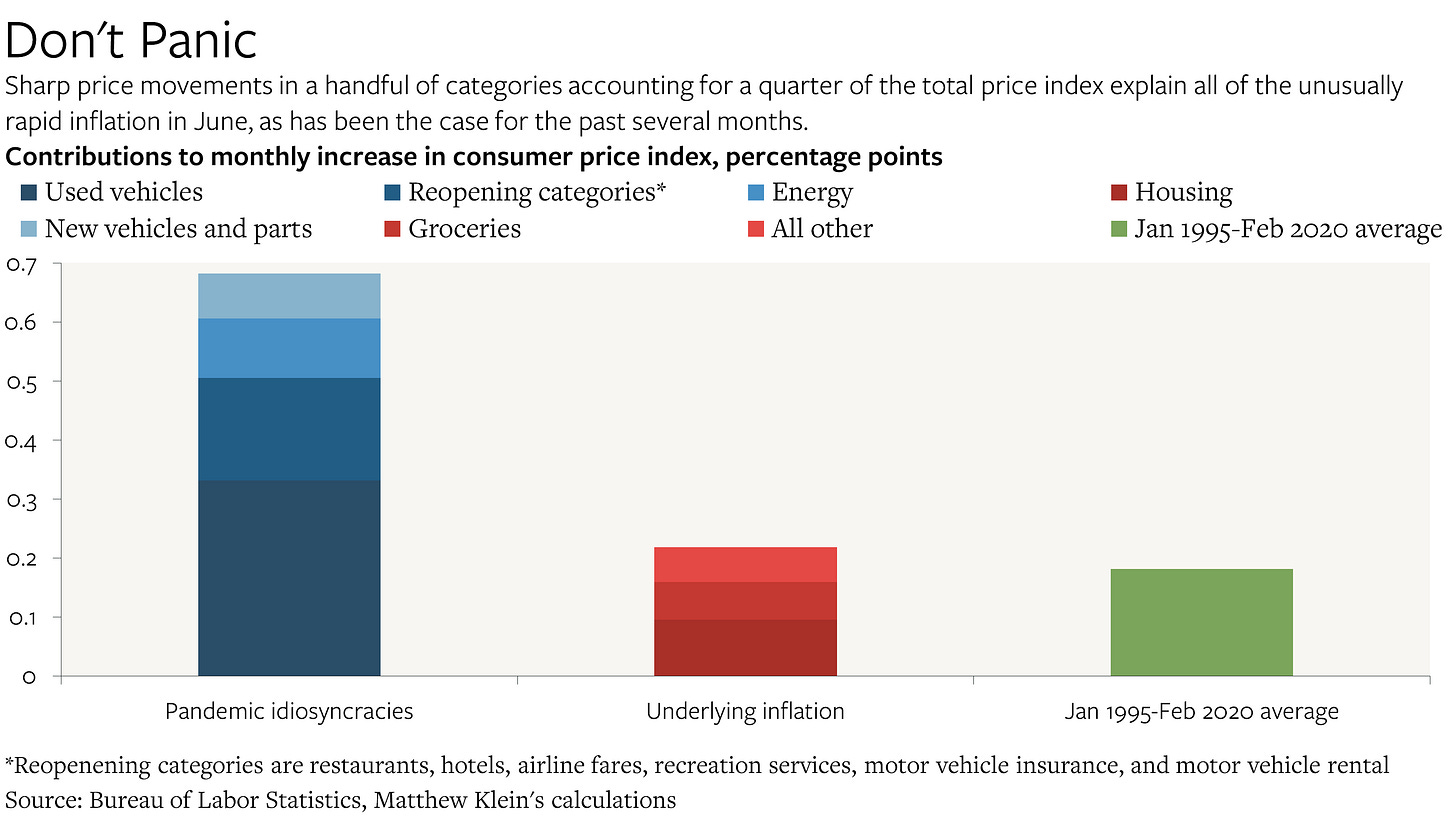

Then I took a quick look at the June numbers for the U.S. Consumer Price Index. As has been the case for the past few months, the somewhat alarming headline numbers were masking a more interesting story underneath.

I next turned my focus to an intriguing announcement coming from the People’s Bank of China about a change to banks’ required reserve ratio. Digging into the rationale required a bit of sleuthing into China’s balance of payments as well as the relationship between China’s banks and the PBOC. My tentative conclusion was that the RRR reduction was meant to compensate state-run lenders for surreptitiously intervening in the currency markets to hold down the value of the yuan.

After that, it was time for a quick update on U.S. industrial production and retail sales. The chip shortage was still having a big impact on the number of motor vehicle assemblies while consumer spending continued its desirable shift from goods to services.

Next, I looked into what we should have learned about banking regulation from the experience of the pandemic. It turns out that preventing bank failures is pretty easy, and that good macro policy can do a lot of the heavy lifting by preserving collateral values and incomes. But we still should want rules that might seem onerous because the alternative is a regime of massive “excess profits” accruing to a small group of workers, managers, and investors who happen to have the good fortune to work in an industry that can’t be allowed to fail.

Then I wrote about two important new papers on subjects core to the thesis of The Overshoot.

First up was a study by J.W. Mason, Mike Konczal, and Lauren Melodia of the Roosevelt Institute that attempted to quantify just how many potential workers are being left behind, or, alternatively, how many more adults the U.S. economy could productively employ if there were sufficient demand for labor. They found—and I think their numbers are broadly plausible—that the U.S. has the potential to add nearly 40 million jobs from the population of people currently here over the next decade purely with policies that raise consumer spending.

After that came my review of an important paper from Philippa Sigl-Glöckner, Max Krahé, Pola Schneemelcher, Florian Schuster, Viola Hilbert, and Henrika Meyer published by the Dezernat Zukunft’s Institute for Macrofinance about how to improve German fiscal policy. It turns out that a lot can be done to fix this problem without changing the German constitution—if lawmakers are willing to change how statisticians estimate Germany’s economic “potential.”

The following week (July 26-30) was an insanely busy one for anyone keeping track of the global economy. Here’s a brief list of some of the things I didn’t cover:

The Fed’s July meeting + Jerome Powell’s press conference

The Q2 Employment Cost Index

The June PCE inflation numbers

Europe’s Q2 flash GDP and flash HICP inflation numbers

I did however look at the U.S. housing market, which seems to have turned a corner in terms of higher supply and lower demand, leading to the end of what I called “surge pricing”. Like toilet paper before it, the pandemic-induced panic buying seems to have abated. That’s not a prediction that prices will go down, but stories about massive price increases, inventory shortages, and bidding wars will probably be less frequent going forward.

Then I turned to the American manufacturing sector, which is really a story in three parts: motor vehicles, civilian aerospace, and everything else. Strong domestic demand is doing wonders for U.S. producers even as exports remain depressed due to weakness in the rest of the world.

Finally, I did two big pieces on the latest revisions to U.S. GDP and personal income.

My first one focused on how new data sources and methodology mean that spending on rent has been much lower than previously believed, while corporate profits were substantially higher.

Then I published a close look at the impact of the new income and spending estimates on household saving. Big downward revisions to wage and salary income—and higher tax payments—mean that Americans have been dipping into their hoard of excess cash since March, although the aggregate impact has been hidden so far thanks to the disbursements of aid from the American Rescue Plan Act.

That’s it for this month’s recap of The Overshoot. Stay tuned for another note previewing some of the things you can expect in the weeks ahead.