The Statistical Discrepancy Returns! (In the Other Direction)

The reported value of the goods and services produced in the U.S. is now exceeding the reported income ostensibly generated in the U.S. by the most since the global financial crisis.

The measured value of the goods and services produced in the U.S. and the reported income generated in the U.S. should be the same. At the very least, they should more or less move in the same direction. Yet that is not happening.

Real domestic product net of depreciation (NDP) in January-March 2023 was 1% higher than in July-September 2022 on a seasonally-adjusted basis, according to the latest estimates from the Bureau of Economic Analysis (BEA). But real incomes generated in the U.S. (NDI)—which should be exactly the same—were ostensibly 2% lower. The corollary is that the “statistical discrepancy” between domestic income and domestic production has swung by 3 percentage points in the space of 2 quarters.

While large moves in the discrepancy have sometimes corresponded to cyclical turning points, the current divergence likely reflects limitations in the available data more than anything else. The gap between the two series should therefore shrink as the BEA revises its estimates with the benefit of additional information from underlying sources.

What follows is my attempt to identify the likeliest sources of the discrepancy between GDP and GDI. I also address some of the issues presented by the Federal Reserve’s negative net interest income.

About half of the drop in GDI can be explained by new estimates of wages that more or less undo an earlier revision (from February), but do so in a lumpy way. The rest seems to be attributable to the recent behavior of net interest payments ostensibly paid by businesses—estimates that may be misleading.

But first, some context.

The Statistical Discrepancy in 2021-2022

Regular readers know that this is not a new problem. NDI exceeded NDP by as much as 5% last year. That confused me a great deal, and inspired a fair amount of digging before the BEA cleared things up with its September 2022 benchmark revisions:

U.S “Excess” Household Savings and the Balance of Payments (January 25, 2022)

Are the U.S. GDP data missing a capital spending boom? (February 16, 2022)

U.S. Economic Data Aren’t Adding Up (May 27, 2022)

Solving One Puzzle in U.S. GDP Data (Maybe), Finding More (August 31, 2022)

The Covid Recovery Looks Different Now (September 30, 2022)

At the time, I thought this puzzle could potentially be explained by the misclassification of certain forms of investment spending as intermediate consumption. Companies buying parts to build their own servers in-house, for example, might expense their purchases instead of treating them as capital spending, and that accounting treatment might then flow through to the BEA’s estimates of spending on “material inputs”, which are netted out from estimates of domestic production.

My thinking was based on the BEA’s convention of attributing the statistical discrepancy to “domestic private business”, as well as the BEA’s own research showing that corporate profits, proprietors’ income (small business and self-employment income), and capex are the components of GDP/GDI most prone to revision.

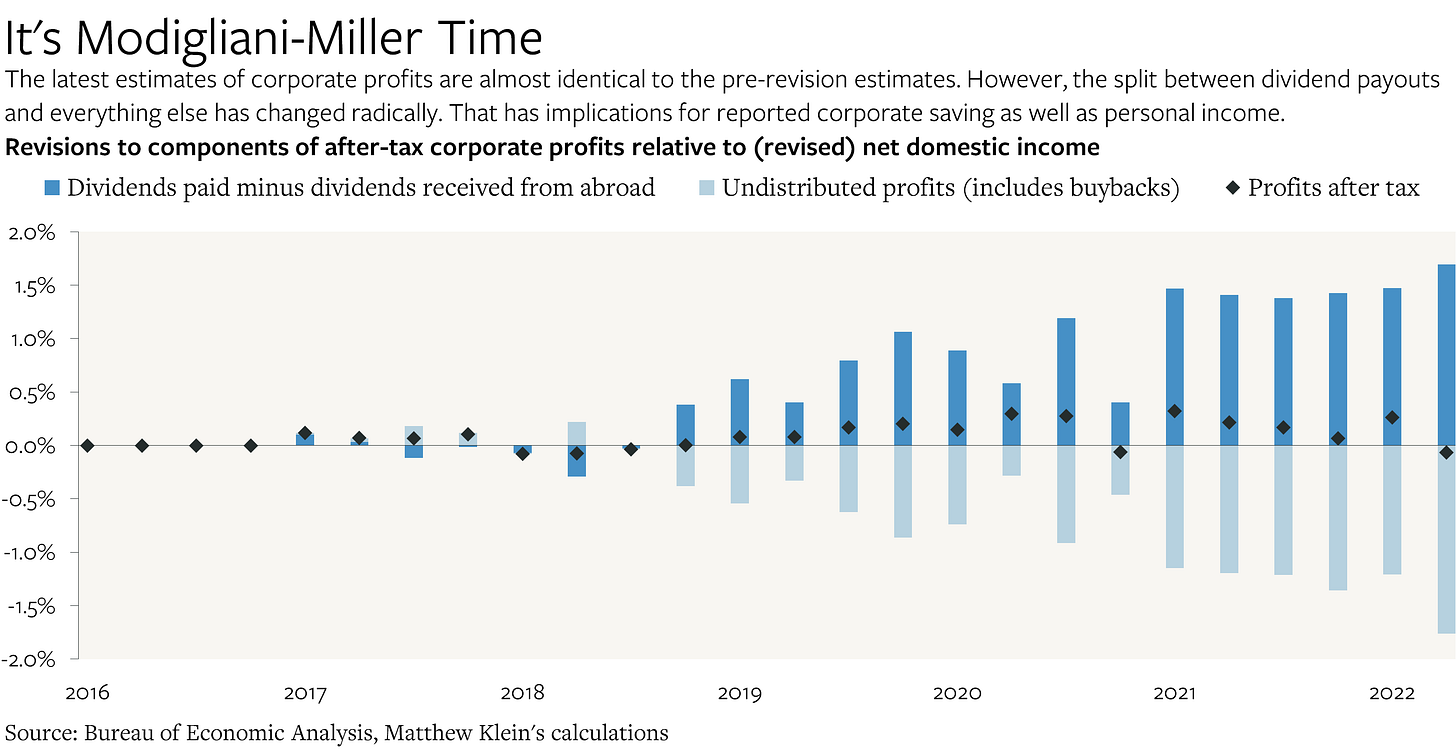

As of now, the official explanation is a bit different (see my note from September 2022 for more details, although nonresidential structures investment may still be undercounted). First, wage income in 2021-2022—which should be among the more straightforward components to track—was revised down. Second, consumer spending, particularly on pandemic-affected services, was revised up. Third, services exports were revised up. And finally, the dividend payout ratio was revised up a lot, which mechanically lowered “corporate savings” without affecting corporate profits.

With the benefit of hindsight, the discrepancy between GDI and GDP in 2021 now looks to be close to zero.

As recently as last month, the discrepancy seemed as if it had stayed away. When the BEA published its second estimate of 2022Q4 GDI/NDI at the end of April, the gap with GDP/NDP was just 0.02%.

What changed?