U.S. Inflation in May: More Mixed News

Some charts on what's good and what's bad.

I’m currently on my way to a conference so this will be light on text and heavy on pictures. Last month’s note is a good starting point for those wanting deeper analysis.

The Consumer Price Index was 1% higher in May vs. April on a seasonally-adjusted basis, thanks largely, although by no means exclusively, to the ongoing disruptions in the supply of energy, agricultural commodities, and motor vehicles.

Unfortunately, the disruptions to the world’s supply of food, energy, and industrial commodities due to Russia’s ongoing war on Ukraine show no signs of easing.1 Until that changes—or unless we are able to find ways to substantially increase supply and/or efficiency—we should expect continued inflation and an erosion of living standards.

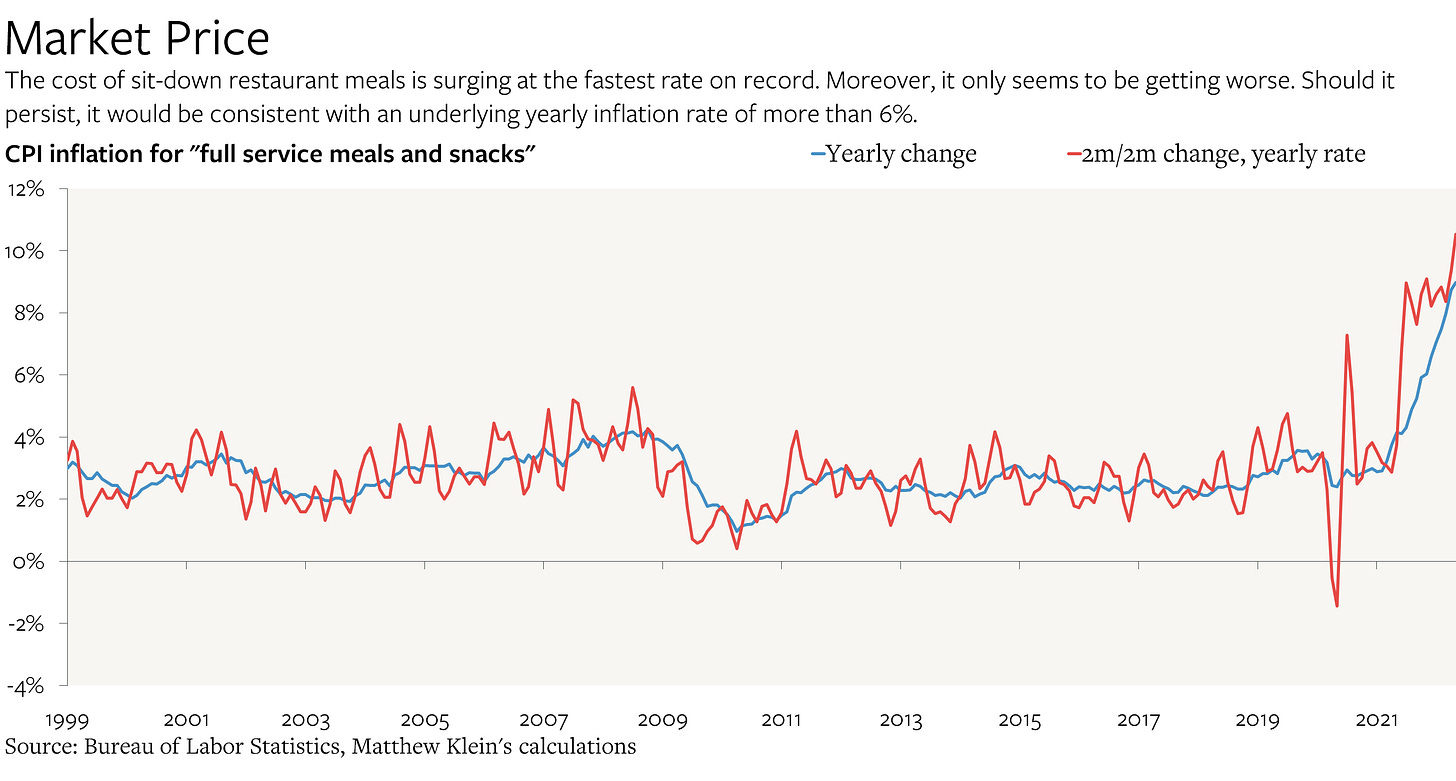

For those concerned with domestic sources of U.S. inflation, however, the most concerning feature of the latest release was the continued acceleration in the price of sitdown restaurant meals. This category has a small weight in the overall index, but it tends to be the single best reflection of underlying price pressures.

That said, there are some encouraging bits of news in the latest report.

First, the prices of many manufactured goods that had surged earlier in the pandemic and reopening have either stopped rising or started going down.