The Overshoot Turns 2!

A look back at a productive and tumultuous time.

It has been just over two years since I left a secure and well-paying job to launch The Overshoot.

When I started, I was part of a broader trend of Americans leaving their jobs and becoming entrepreneurs. The total number of applications for federal business tax IDs soared during the pandemic and has yet to come down at all.

In July 2021, the number of people who were self-employed in unincorporated nonagricultural businesses—like me—was 8% higher (700,000 people) than it was in January 2020 on a seasonally-adjusted basis.1

Two years ago, I was unsure whether I could pull it off, but I am happy to report that I now have a viable business providing essential insights to all of you who read and subscribe.

I now sell my research and analysis to hedge funds, asset managers, investment banks, family offices, insurers, central bankers, government officials, and academics all over the world, as well as many other readers who want to understand what is happening in the global economy. My work has informed policymakers at the highest levels and been cited on the front page of the New York Times, among other places.

Thanks to you, I get to dive deeply into the subjects that interest me, I get to engage with some of the smartest minds in the field, and I even get to play a small role in improving public policy. I am incredibly grateful for all of this. Thank you!

I am also grateful that I was able to take 8 weeks of parental leave after our second child was born with almost no change in subscriptions or revenue. That means so much to me, and I hope that my experience can encourage others who are thinking of entering this line of work.

In the rest of this note, I want to look back at some of the main themes I have covered and highlight some of my favorite pieces. I hope that existing subscribers, especially those who joined more recently, view this as an opportunity to go through the back catalog. And to the 30,000+ of you who read the free version of this publication, consider upgrading to see what you are missing.

Why Overshoot, Anyway?

One of the questions I grappled with when I started was coming up with a name. I settled on The Overshoot because, as I explained in my very first note, I believe that the global failure to return to pre-2006 real growth trends is the most salient fact of the past 15+ years.

Coming out of the pandemic, I wanted to make sure that we did not repeat that experience. Keeping the economy humming is essential if we are to preserve free and democratic societies. While my day-to-day priority has always been getting the analysis right, I believe that my work is ultimately in the service of this mission.

Fortunately, enough people with power—in the U.S., anyway—agreed with me and acted on their beliefs when they had the chance. As of this writing, it looks as if Americans—despite the death and disruption of 2020-2022—have managed to come out of the pandemic without any persistent losses in aggregate output. That is a policy triumph, and it should be recognized as such.

Unfortunately, the same cannot be said for most other major economies, which still suffer from persistent shortfalls in real consumer spending even though they (mostly) endured comparable inflation shocks.

Avoiding another undershoot (in the U.S.) was a good start, but I also want us to take the opportunity to aim higher. For many societies, the first two decades of this century were not the benchmark but a world-historic failure. We should not limit our understanding of what is possible by relying solely on pre-pandemic growth trends or dubious forecasts of the labor force or productivity. That was why I said that we should try to overshoot and “find out just how much we are capable of producing.”

A few of my favorite notes on this theme:

Let’s Overshoot (July 1, 2021)

The Case for 38 Million More U.S. Jobs by 2031 (July 21, 2021)

How to Improve German Fiscal Policy Without Removing the Schuldenbremse (July 22, 2021)

Pro-Growth Isn't Anti-Environment (August 20, 2021)

Inequality, Interest Rates, Aging, and the Role of Central Banks (August 31, 2021)

Fumio Kishida's "New Japanese Capitalism" Might Be Just What the Country Needs (October 8, 2021)

Kornai, Keynes, the Coronavirus, and Kant (November 3, 2021)

The Pandemic's Impact on Business Dynamism in the U.S. and Europe (December 8, 2021)

Reconsidering the "2020s as 1940s" Analogy (March 8, 2023)

Inflation Makes Things Harder

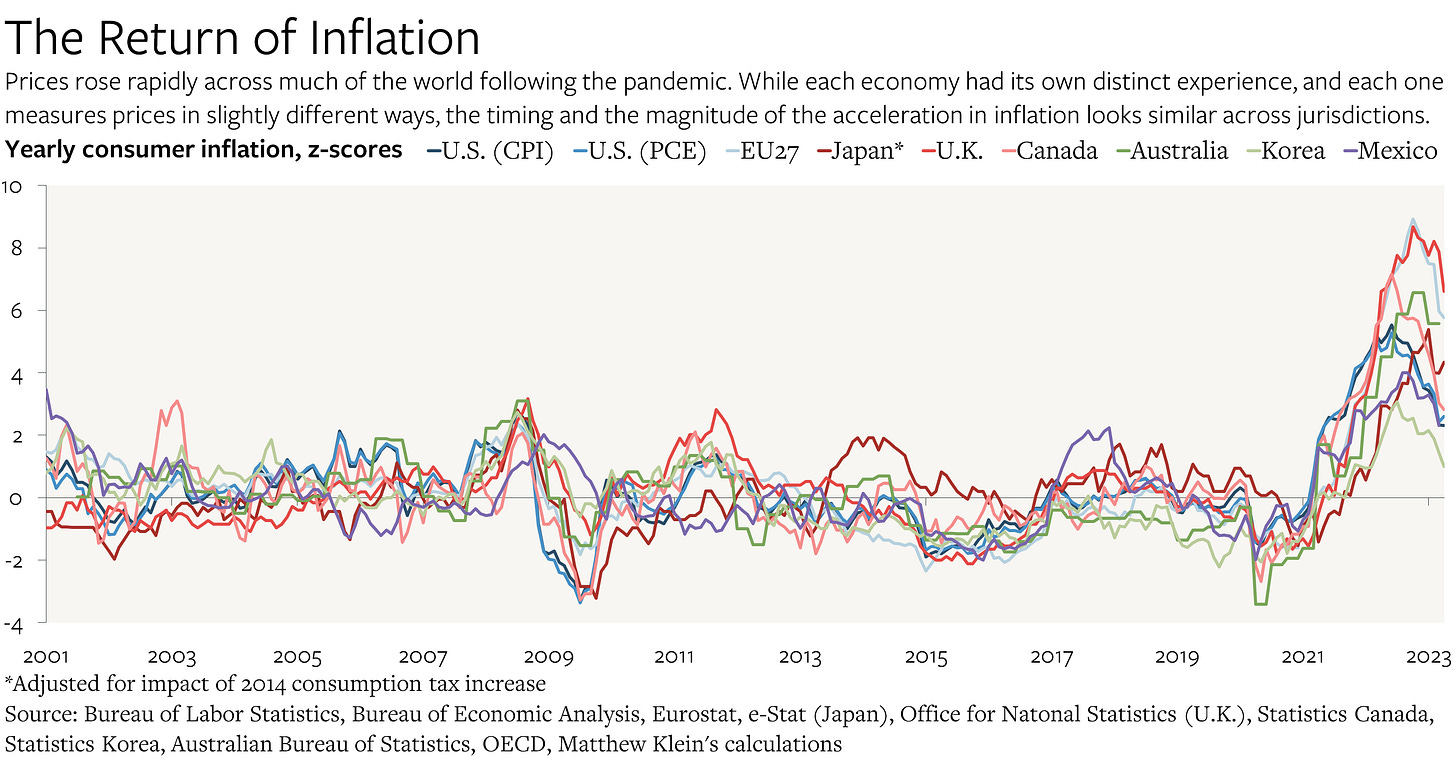

Inflation is what happens when nominal spending rises faster than real production. Many societies experienced violent accelerations in their inflation rates in 2021-2022, although things have cooled off somewhat more recently.

The challenge for analysts and policymakers has been disentangling the various sources of inflation to determine the best way to get prices back into line—ideally without crushing the economy.

In 2020, I was among the first to identify how pandemic-related disruptions in specific sectors were causing some prices to spike even as others cratered, and that the apparent calm in the aggregate inflation numbers was misleading. I also noted that some inflation would be helpful in smoothing out the costs of the pandemic and the economic adjustments that I had thought would be needed in the transition to a post-pandemic world.

In 2021, I was at the forefront of decomposing broad headline price level increases into specific components. Those efforts helped inform my then-judgment that inflation would (mostly) go away on its own as the public health situation normalized—although I also warned about the danger that temporary price spikes could eventually lead to persistent changes in behavior. At the end of that year I made my “case for patience on inflation”. By the middle of 2022, many of the signs of progress that I had been waiting for were starting to show up.

The big question was whether those positive trends would continue. I was optimistic that they would, but that turned out to be (mostly) wrong. Even though indicators from the quit rate to “supply chain pressures” are either back to normal or less inflationary than before the pandemic, both underlying wage growth and underlying inflation are still about 2-3 percentage points faster. Somewhat perversely, my August 9, 2022 note on the job market seems to have marked the end of the benign slowdown that had been occurring since the end of 2021.

As the months have gone on and more and more have data come in, my optimism about the prospects of an “immaculate disinflation” has been replaced by a belief that the inflationary trend will not fully normalize without significant costs to consumers, workers, and businesses. I do not think these costs would be worth the benefits, although others (whom I respect) disagree. Most of the central banks that are grappling with this question have been reluctant to commit either way, instead forecasting that inflation will normalize without much, if any, hardship.

For better or worse, I have probably written more about inflation over the past two years, particularly U.S. inflation, than any other subject. Below is a list of my favorite pieces on the subject—including one on Japan’s unique circumstances and one based on my exclusive interview with Jonathan Haskel of the Bank of England—which trace my evolving views:

Paying the Covid Bill (October 19, 2021)

The Case for Patience on Inflation (November 14, 2021)

Understanding Covid-flation (January 19, 2022)

What Should We Do About Inflation? (Part 1) (June 14, 2022)

What Should We Do About Inflation? (Part 2) (June 22, 2022)

Is America's Job Market "Too Good"? (August 9, 2022)

Wages, Prices, and Taming U.S. Inflation (October 19, 2022)

The Japanese Government Is Right to Defend the Yen (Part 1) (October 27, 2022)

Patience on Inflation Is Paying Off. Sort of. (November 17, 2022)

Immaculate Disinflation Hopes Dashed? (December 3, 2022)

The Bank of England's Jonathan Haskel on Inflation, Productivity, Brexit, and More (February 13, 2023)

Inflation In The *Very* Long Run (May 12, 2023)

"Greedflation" and the Profits Equation (June 10, 2023)

America's "Excess Savings" Are Going Away. Inflation Is Not. (June 30, 2023)

War, Peace, and (De-)Globalization

I was interested in international relations and military/diplomatic history long before I knew any bond math or even how to make a chart. I wish that the past few years had not made my particular combination of skills and knowledge so useful, but given the world we live in, I am glad to be able to do what little I can to help.

In some ways, this has been a natural extension of the work that began with Trade Wars Are Class Wars. The point of the book, after all, was to promote prosperity and peace by explaining how the different parts of the global economy affect each other. When Michael Pettis and I wrote the book, our concern was that ignorance would lead to impoverishment and, eventually, to conflict. That concern remains relevant, but now that conflict has happened anyway (albeit for unrelated reasons) it turns out that a sound understanding of financial flows, the balance of payments, and the links between domestic and external economic conditions is also useful because it can be weaponized.

What follows are a few of my favorite pieces on this broad theme, which mostly—but by no means exclusively—involves my Russia-Ukraine research:

What is Going On in China? (September 2, 2021)

Appeasing the Chinese Government "For the Climate" Makes No Sense (October 21, 2021)

Russia's Industrialization and WWI (December 22, 2021)

Russia Was Already Cutting Off Europe's Gas Before Invading Ukraine. What Can Be Done? (February 24, 2022)

The Implications of Unrestricted Financial Warfare (March 8, 2022)

How to Dominate the Economic Battlefield with a "Freedom Fund" (March 24, 2022)

The Sanctions Are Already Working (April 21, 2022)

On the Russian Oil Sanctions (June 2, 2022)

China's Unbalancing Is Going Into Overdrive (July 22, 2022)

The Sanctions' Impact on Russia (August 19, 2022)

Trade Wars Are Class Wars, 32 Months Later (Part 1) (September 7, 2022)

Some Thoughts on U.S. International Economic Statecraft (January 18, 2023)

Whither Globalization? And What Would that Even Mean, Anyway? (February 7, 2023)

Closing the Gaps in the Sanctions on Russia (February 21, 2023)

Where Has Russia's Current Account Surplus Gone? (June 1, 2023)

An American Investment Boom Would Be Good for the World (June 13, 2023)

Banking, Financial Flows, and Data Puzzles

Much of my work starts from the premise that everything should add up in ways that are consistent with axiomatic economic and financial relationships. (Every transaction has two sides, etc.) This can sometimes lead me to strange places, whether it is the “statistical discrepancy” between the value of goods and services produced in the U.S. and the value of income generated in the U.S., the gap between China’s trade surplus as reported by the People’s Bank of China in the balance of payments vs. the General Administration of Customs, or the ways that Ireland’s status as a corporate tax haven are reflected in its domestic and external accounts.

Even when there are no obvious puzzles to be solved, I enjoy—and many of you appreciate—tracking flows of financing and reconciling them across multiple data sources to answer questions such as “who is buying U.S. Treasury debt?” or “how is the current account being financed?” or “what does it actually mean when the Federal Reserve buys mortgage-backed securities?” or “what are ‘excess savings’ and where did they go?”. This analytical approach also informs my understanding of the money markets and banking system, which are pieces of a larger whole connected to central banks, households, nonfinancial businesses, and more.

Below are a few of my favorite pieces on this broad theme:

The Fed, MBS, and housing (July 6, 2021)

Understanding China's Latest RRR Cut (July 15, 2021)

Bank Regs Are Excess Profit Taxes (July 20, 2021)

Who Is Financing the Federal Government? (October 1, 2021)

What's going on with interest rates? (Part 1) (November 9, 2021)

What's going on with interest rates? (Part 2) (December 3, 2021)

U.S "Excess" Household Savings and the Balance of Payments (January 25, 2022)

What the New "New Vehicles" Price Index Tells Us (February 9, 2022)

U.S. Economic Data Aren't Adding Up (May 27, 2022)

The Covid Recovery Looks Different Now (September 30, 2022)

The Japanese Government Is Right to Defend the Yen (Part 2) (November 1, 2022)

The "Tech Wreck" and Ireland (December 10, 2022)

How Was the U.S. Current Account Deficit Financed In 2022? (January 13, 2023)

The Mysterious $300 Billion Flow Out of China (February 10, 2023)

"Quantitative Tightening" and the U.S. Banking System (February 15, 2023)

Thoughts on the Bank Bailouts (March 13, 2023)

Banks Are Blowing Up While the Economy is Strong. Time to Worry? (May 10, 2023)

The Case of the Missing Planes (May 18, 2023)

The Statistical Discrepancy Returns! (In the Other Direction) (May 23, 2023)

Who Has Been Buying U.S. Treasury Debt? (June 24, 2023)

Thank you all again for reading and subscribing!

That turned out to be the peak. This shift from unincorporated self-employment to payroll employment (including self-employment at corporate businesses) helps explain much of the recent disconnect between the household survey estimates and the establishment survey estimates of job growth.

Congratulations on two years Matt, and here's to what's more to come!

Love this substack. Would also love if Matt listed some books he was reading just to help with my education.